How to Trade at HFM for Beginners

How to Register Account at HFM

How to Register HFM Account

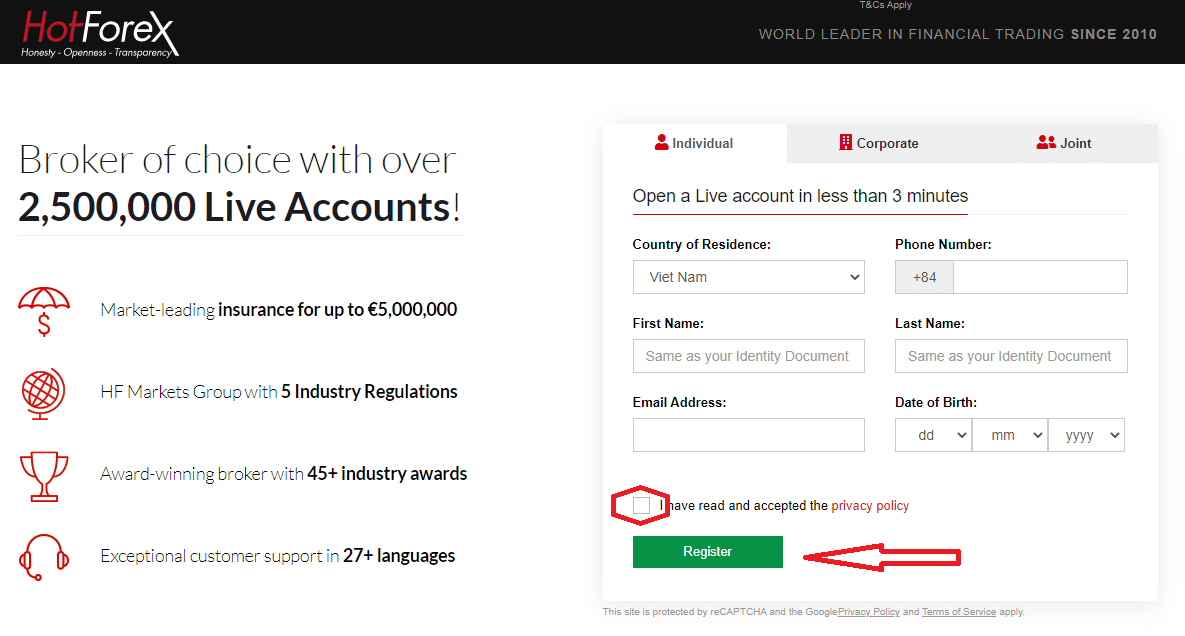

The process of opening an account at Hot Forex is simple.Visit the website Hot Forex.com or click here.

- The demo account allows you to trade risk-free by providing you with access to HFM MT4 and MT5 trading platforms, and unlimited demo funds.

- The live account allows you to open an account with real money to start trading straight away. You simply choose the account type that best suits you, complete the online registration, submit your documents and you are set to go. We advise you to read the risk disclosure, customer agreement and terms of business before you start trading.

In both cases a myHF area will be opened. MyHF area is your client area from where you can manage your demo accounts, your live accounts and your finances.

Firstly, You’ll need to go through the registration procedure and get a personal area. Enter your valid email, full name and the required info as below. Make sure to check that the data is correct; it will be needed for verification and a smooth withdrawal process. Then press on the “Register” button.

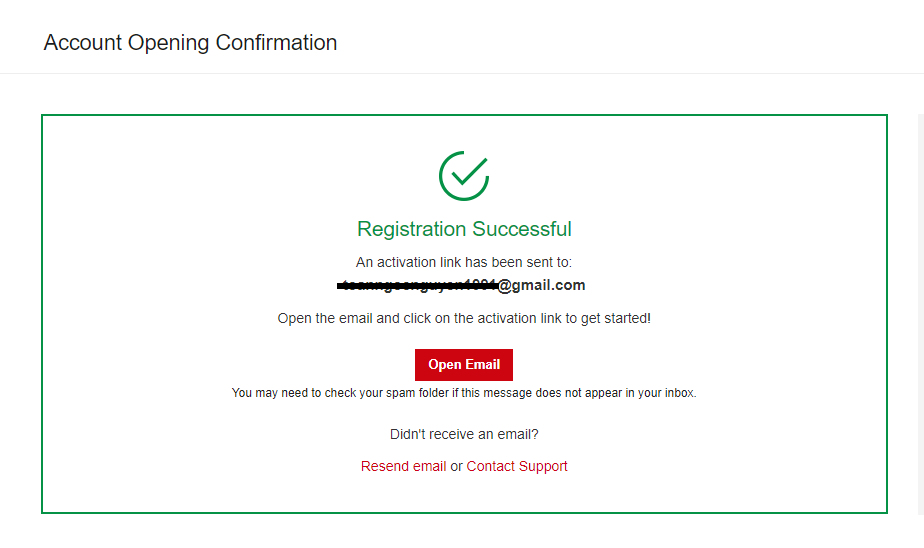

Registration successfully, an email confirmation link will be sent to your email address.

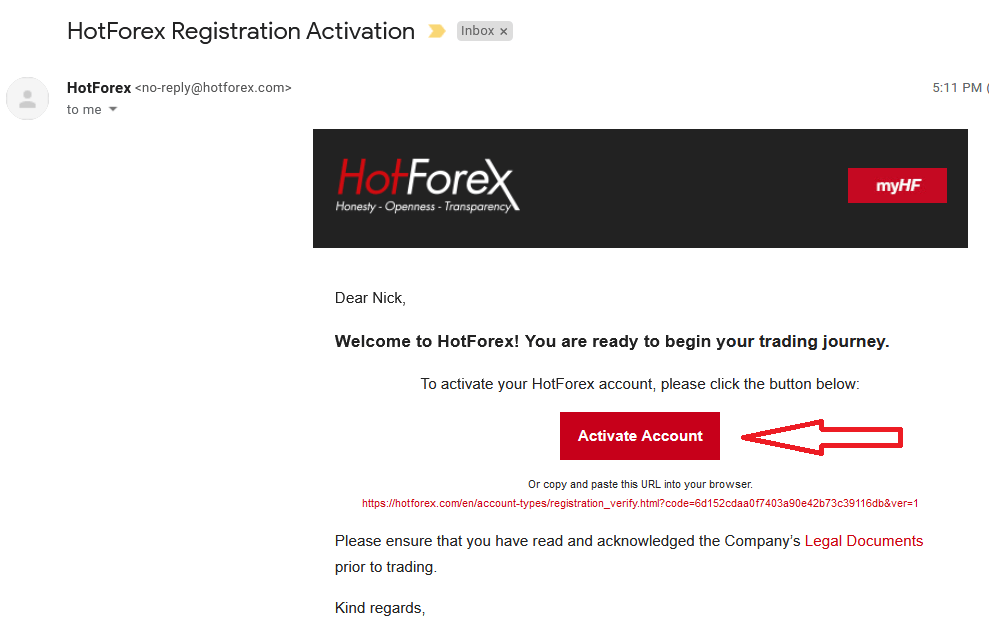

Press "Activate Account". As soon as your email address is confirmed, you will be able to open your first trading account.

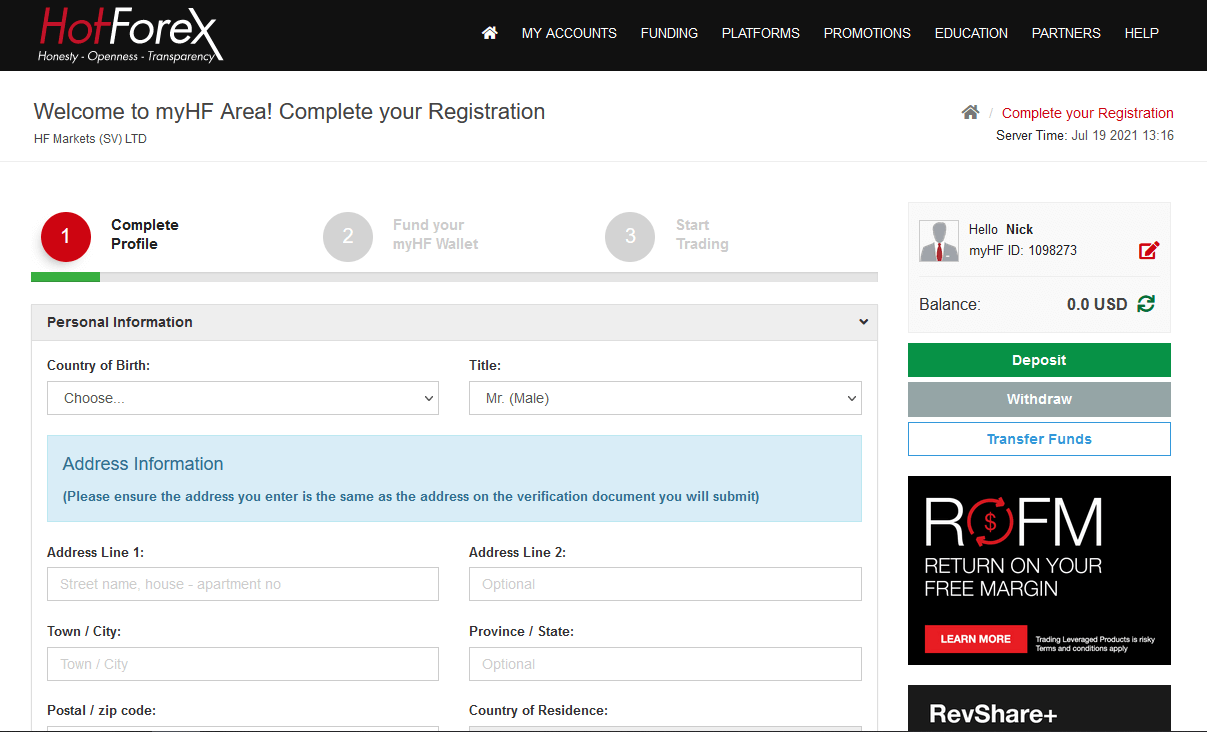

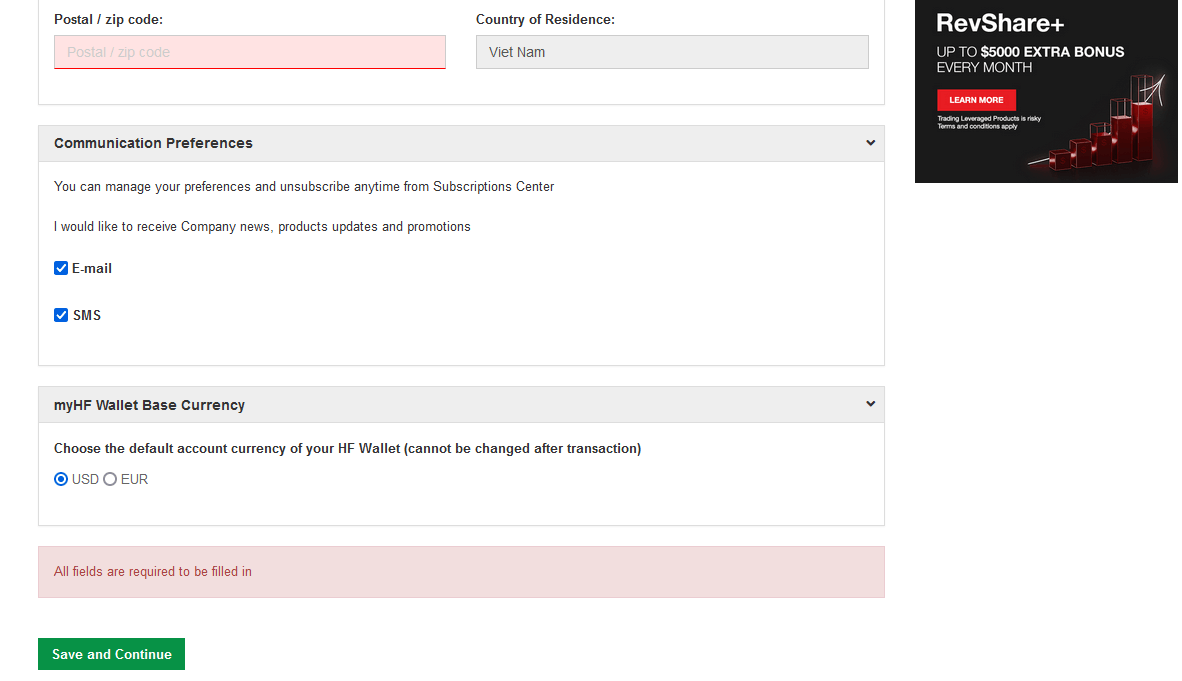

Let’s go through the second option. You need to complete your Profile and press "Save and Continue"

Demo Account

Your practice gateway to the world of trading- The HFM Demo Account has been designed to closely simulate a real trading environment based on actual market conditions. Our belief that the Demo trading environment must reflect the Live trading environment as closely as possible, is completely in line with our core values of Honesty - Openness - Transparency, and ensures a seamless transition when opening a Live Account to trade on the real market.

Gain the trading experience you need and enter the market with confidence.

Advantages of a Demo Account:

- Unlimited usage

- Real market conditions

- Test trading strategies

- Access to trade with the MT4 and MT5 Terminal and Webtrader

- Up to $100,000 virtual opening balance

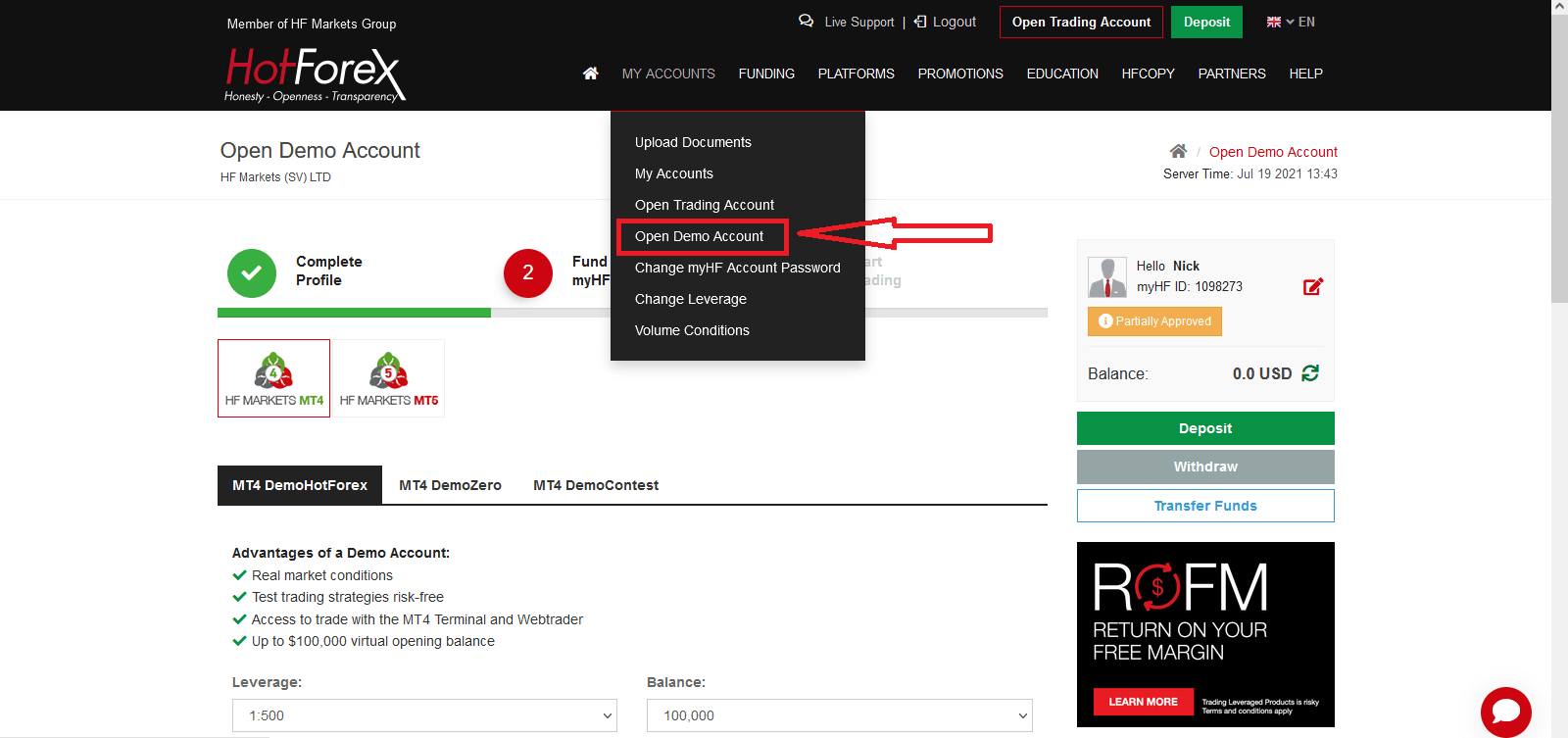

To open a Demo account, Press "My Account" - "Open Demo Account"

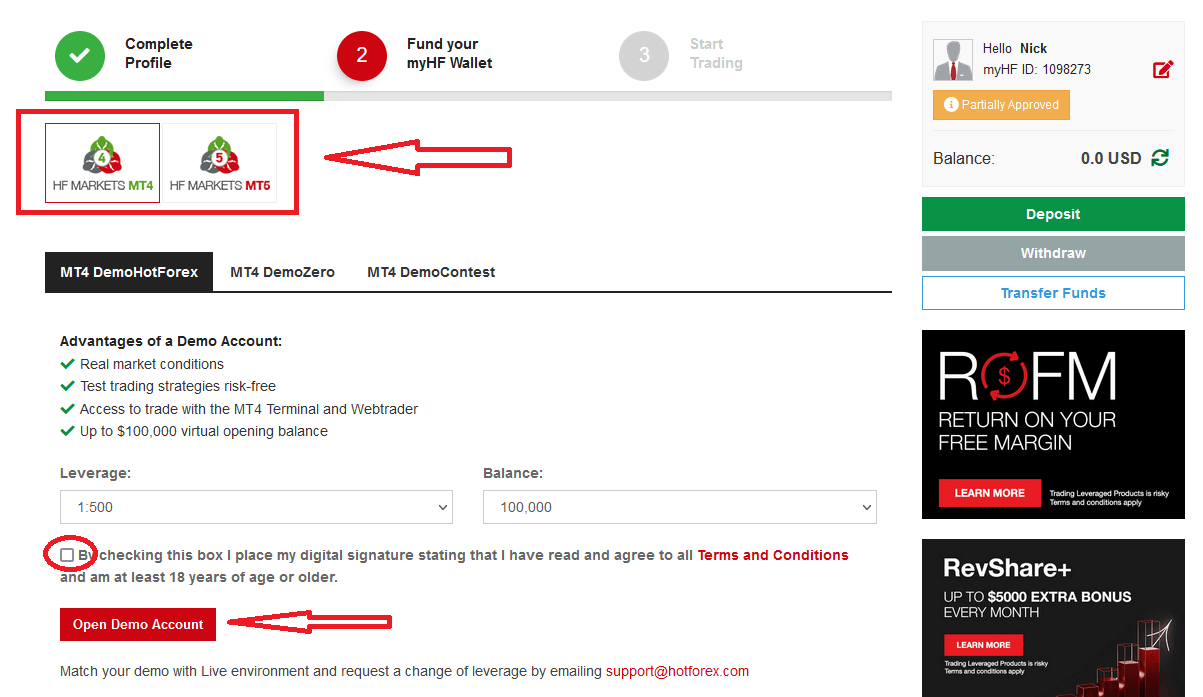

You can choose MT4 or MT5, Check the checkbox and Press "Open Demo Account"

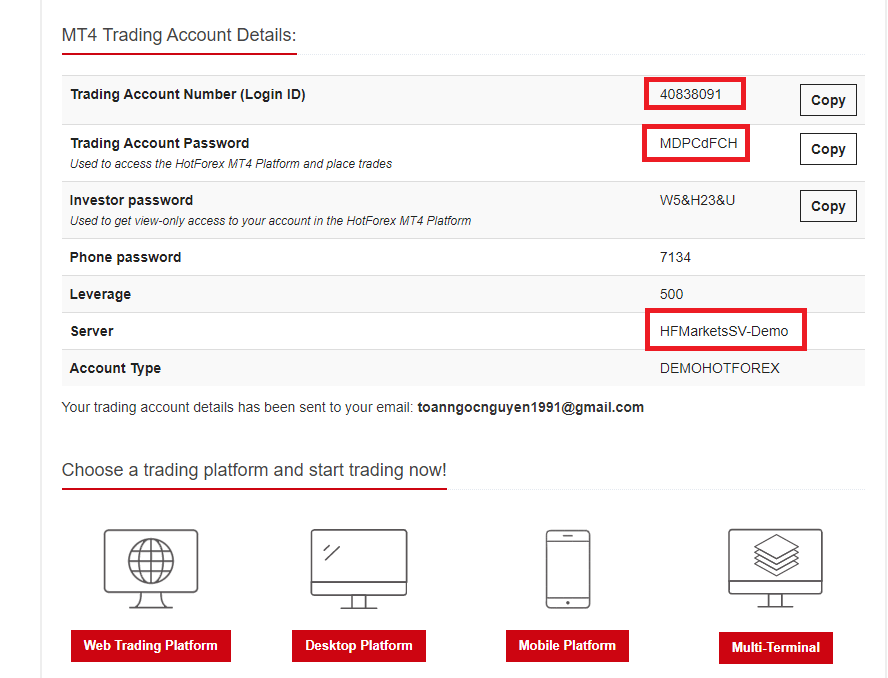

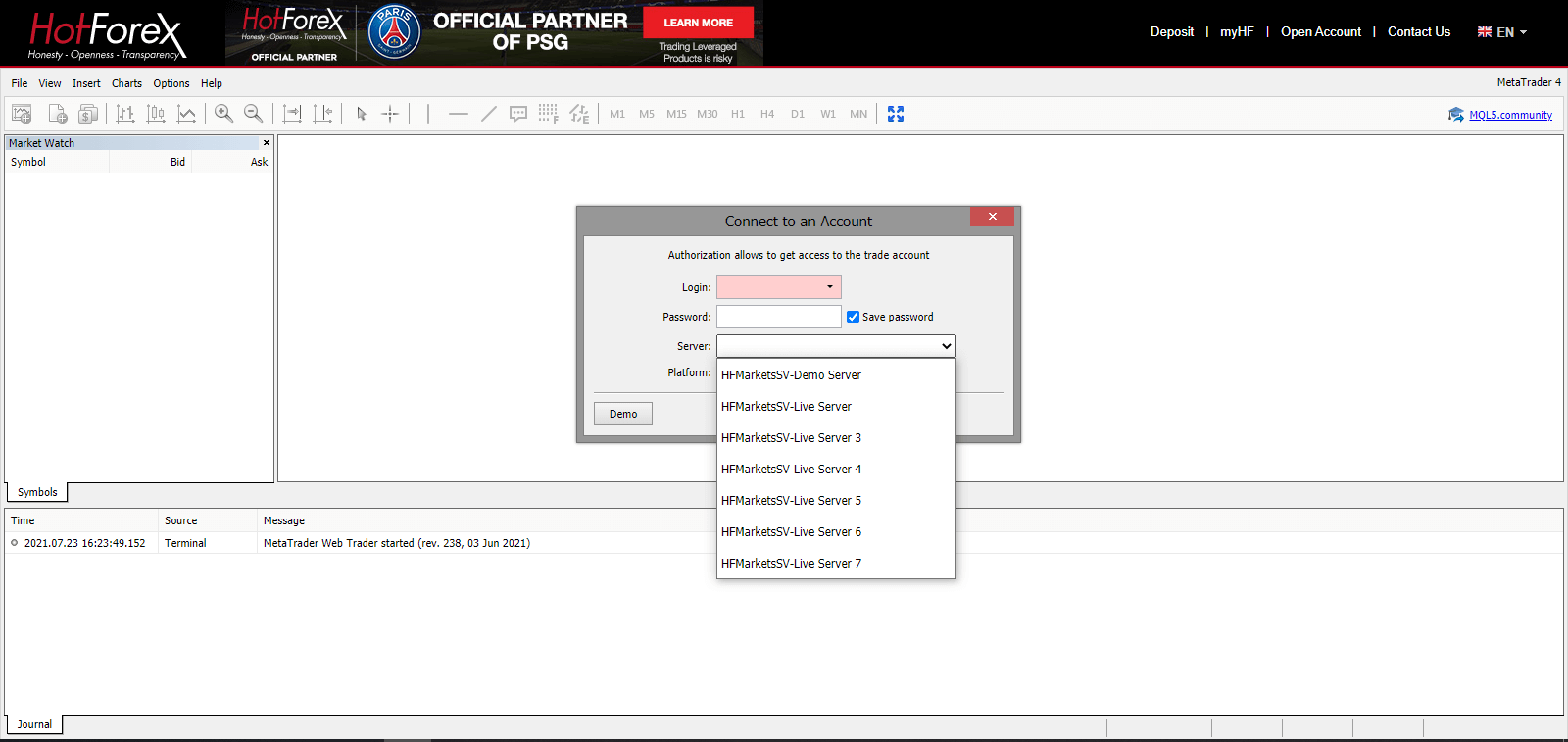

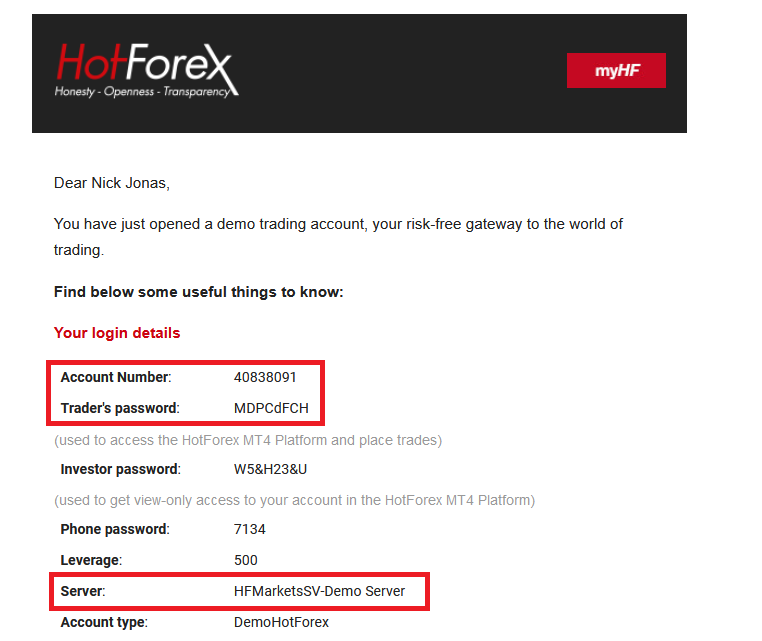

After that, you can use the login detail as below to login MT4 and Trade with Demo Account

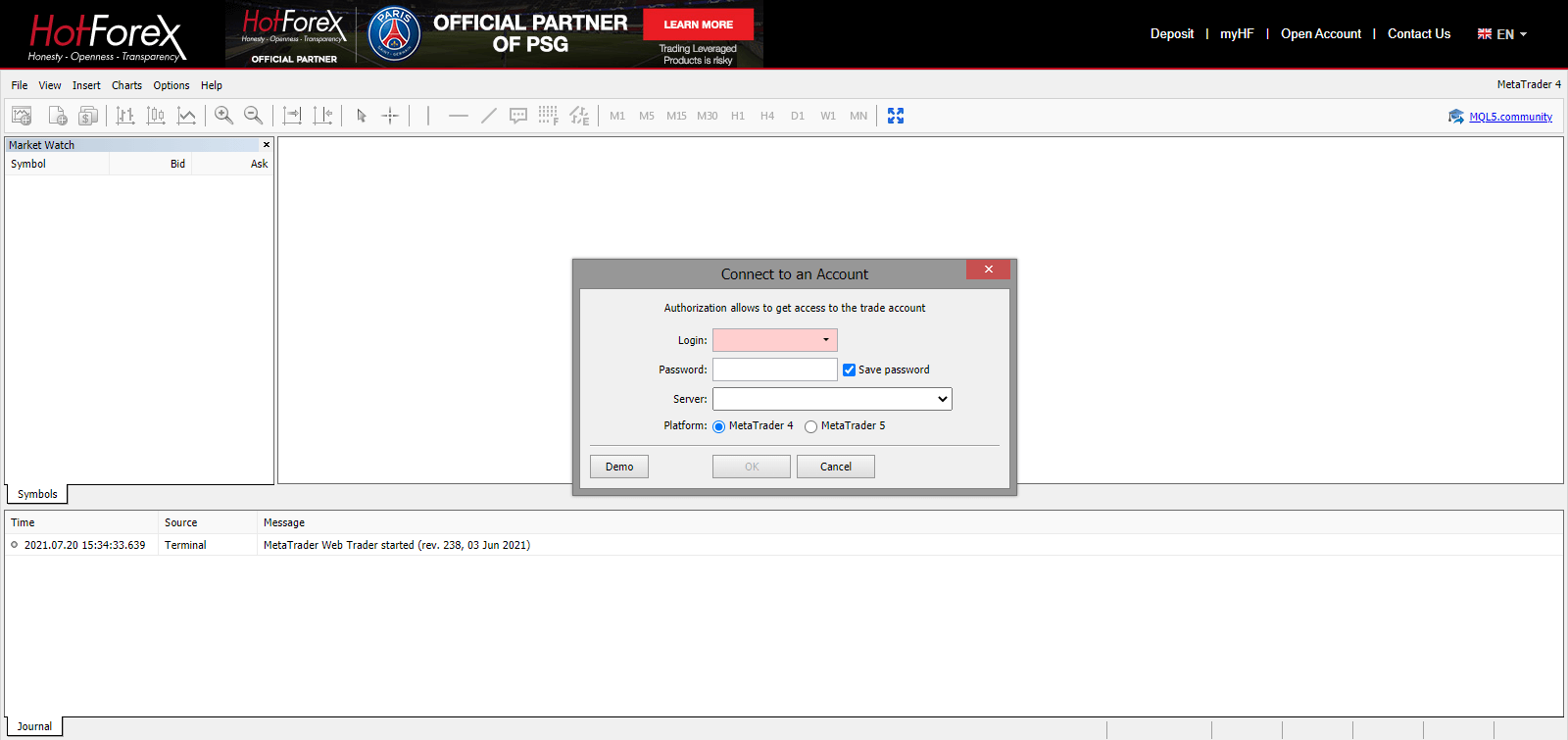

Input Login ID, Password and Server.

Trading MT4 WebTerminal

Real Account

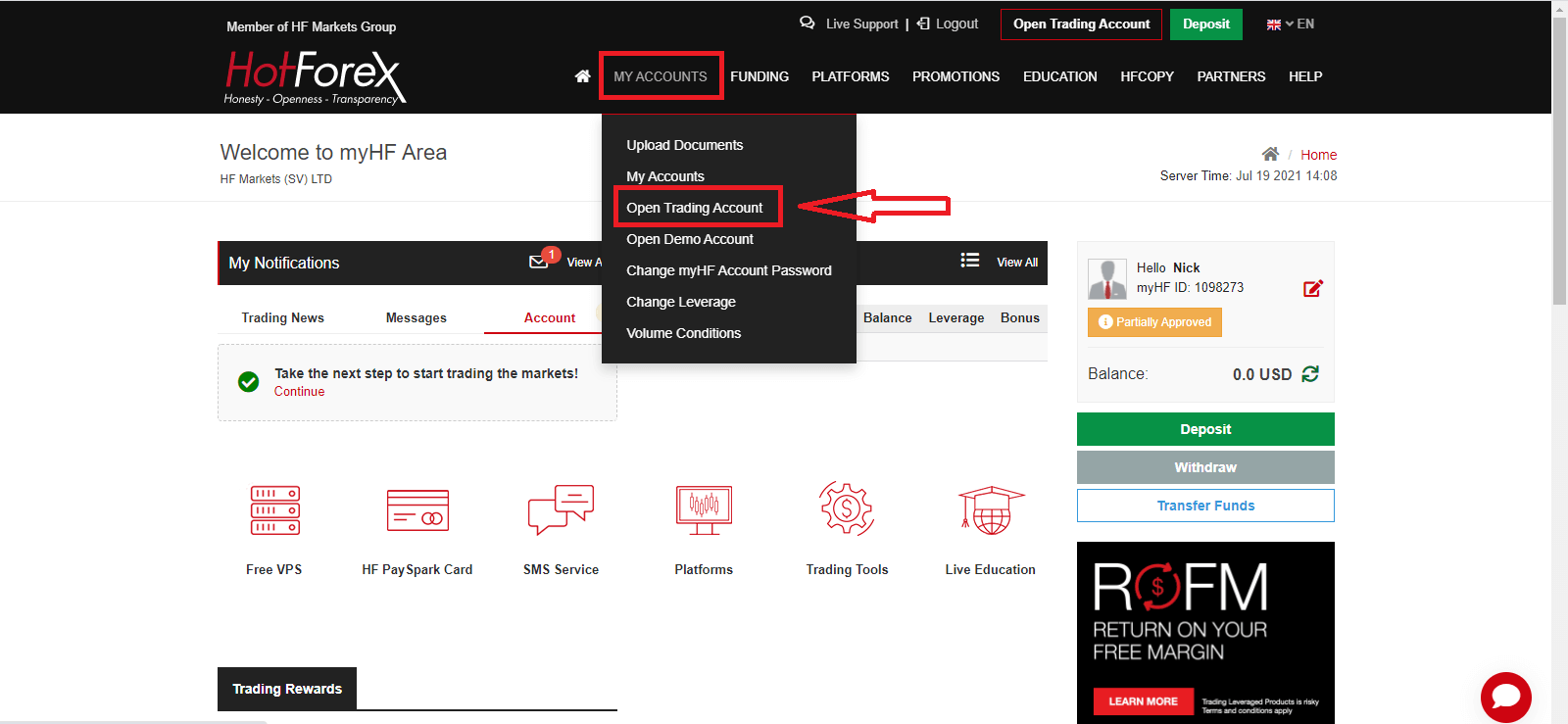

To open a Real account, Press "My Account" - "Open Trading Account".

Fund your myHF Wallet and start Trading

How to Deposit Money to HFM

Hot Forex Android App

If you have an Android mobile device you will need to download the official Hot Forex mobile app from Google Play or here. Simply search for “Hot Forex – Trading Broker” app and download it on your device.

The mobile version of the trading platform is exactly the same as web version of it. Consequently, there won’t be any problems with trading and transferring funds. Moreover, Hot Forex trading app for Android is considered to be the best app for online trading. Thus, it has a high rating in the store.

Hot Forex iOS App

If you have an iOS mobile device you will need to download the official Hot Forex mobile app from App Store or here. Simply search for “Hot Forex – Trading Broker” app and download it on your iPhone or iPad.

The mobile version of the trading platform is exactly the same as web version of it. Consequently, there won’t be any problems with trading and transferring funds. Moreover, Hot Forex trading app for IOS is considered to be the best app for online trading. Thus, it has a high rating in the store.

How to Verify Account in HFM

Documents to HFM

For Live accounts we need at least two documents to accept you as an individual client:

-

Proof of Identification - current (not expired) coloured scanned copy (in PDF or JPG format) of your passport. If no valid passport is available, please upload a similar identification document bearing your photo such as National ID card or Driving licence.

- Valid Passport

- Valid Personal ID

- Valid Driver`s License

-

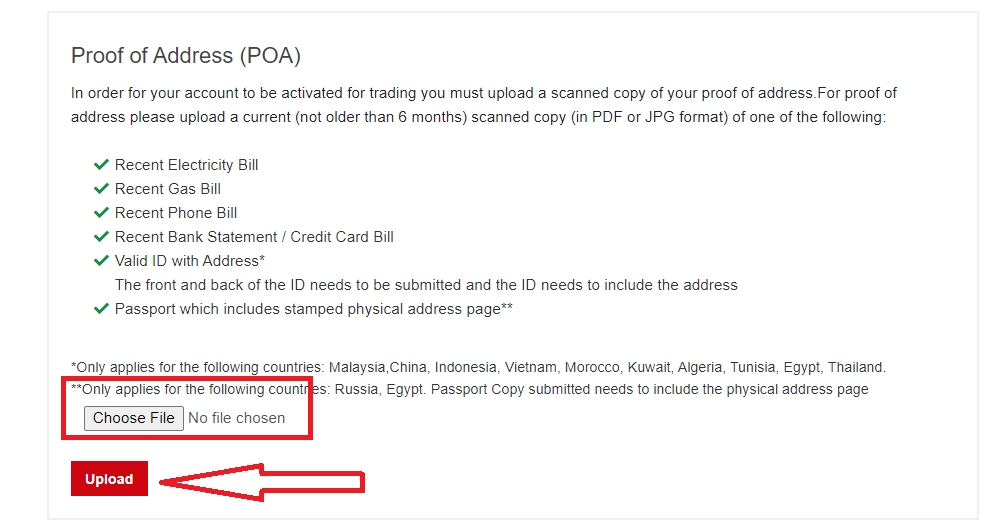

Proof of Address - a Bank Statement or Utility Bill. Please ensure however, that documents provided are not older than 6 months and that your name and physical address is clearly displayed.

- Recent Electricity Bill

- Recent Gas Bill

- Recent Phone Bill

- Recent Bank Statement / Credit Card Bill

- Valid ID with Address* (The front and back of the ID needs to be submitted and the ID needs to include the address)

- Passport which includes stamped physical address page**

**Only applies for the following countries: Russia, Egypt. Passport Copy submitted needs to include the physical address page

Important Note: The name on the Proof of Identification document must match the name on the Proof of Address document.

You can conveniently upload your documents directly from your myHF area; alternatively you can also scan them and send them to [email protected]

Your documents will be checked by the verifications department within 48 hours. Kindly note, any deposits will be credited to the account only after your documents have been approved and your myHF area is fully activated.

Step By Step

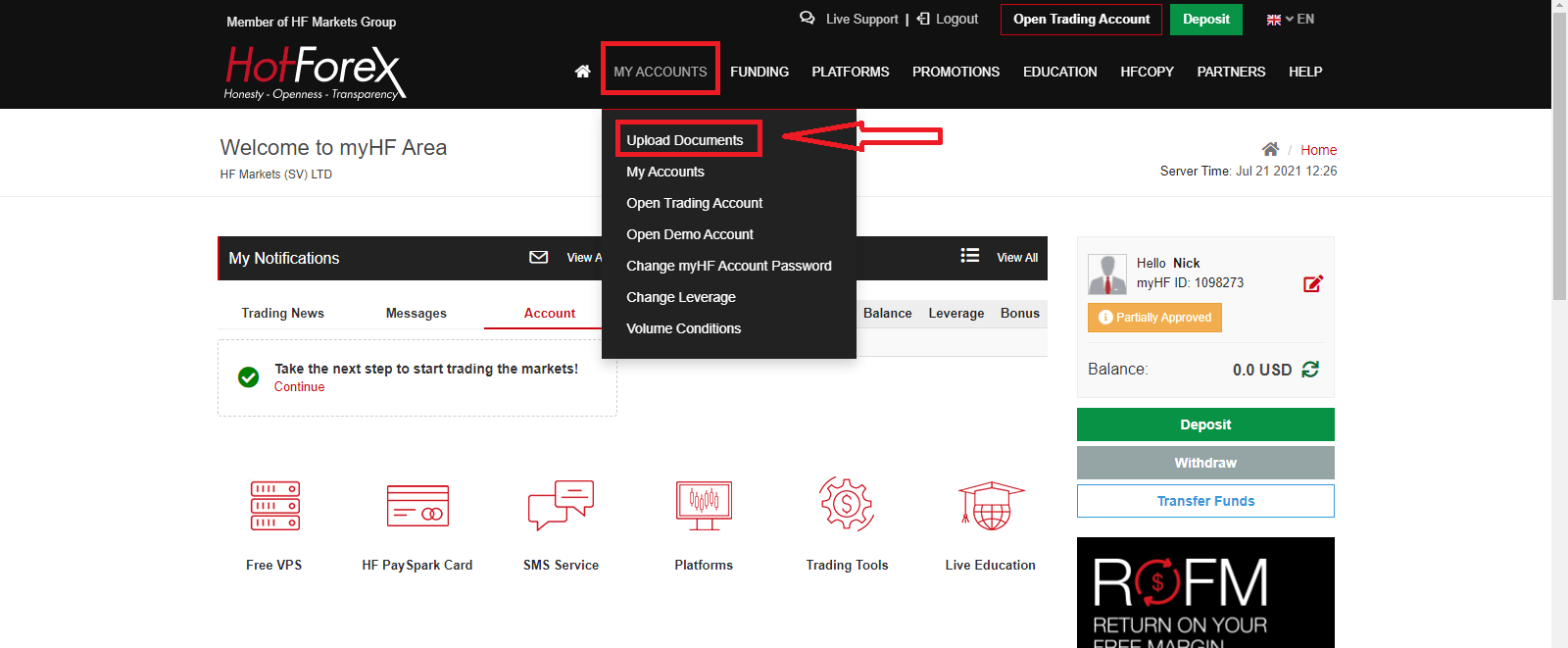

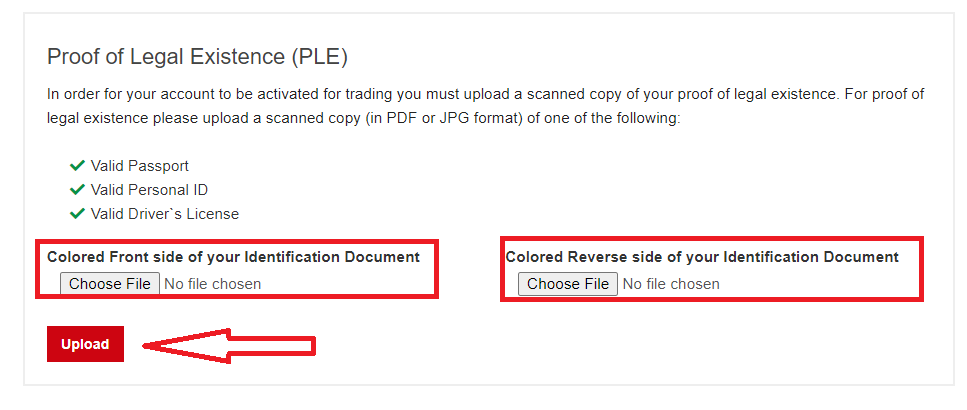

If you want to upload documents and verify account at HFM you need to log in dashboard and then from homepage to choose to upload documents like below:

1. Login to HFM successfully

2. Press "My Accounts" - "Upload Documents"

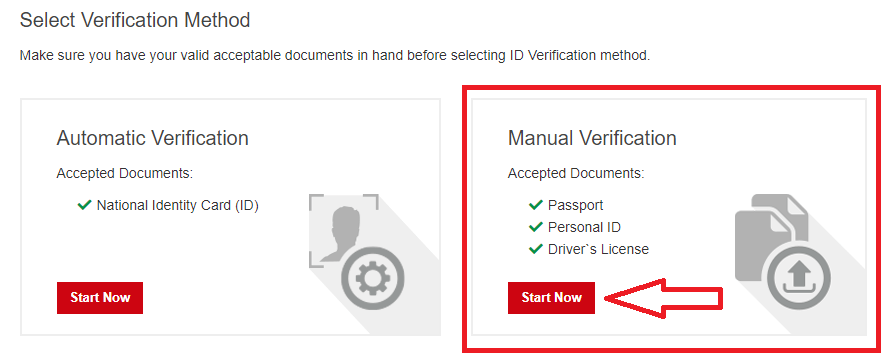

3. Press"Start Now" at "Manual Verification" if you want to have many options to verify your account

4.Upload your documents

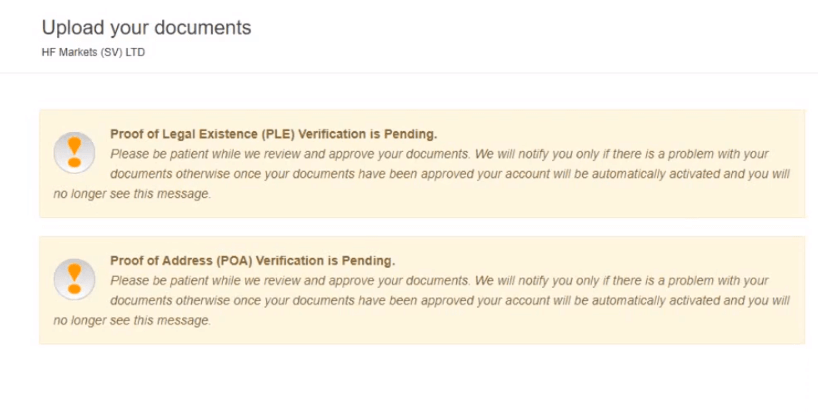

5. Upload Successfully, you will see as below

How to Deposit Funds at HFM

Deposits Methods

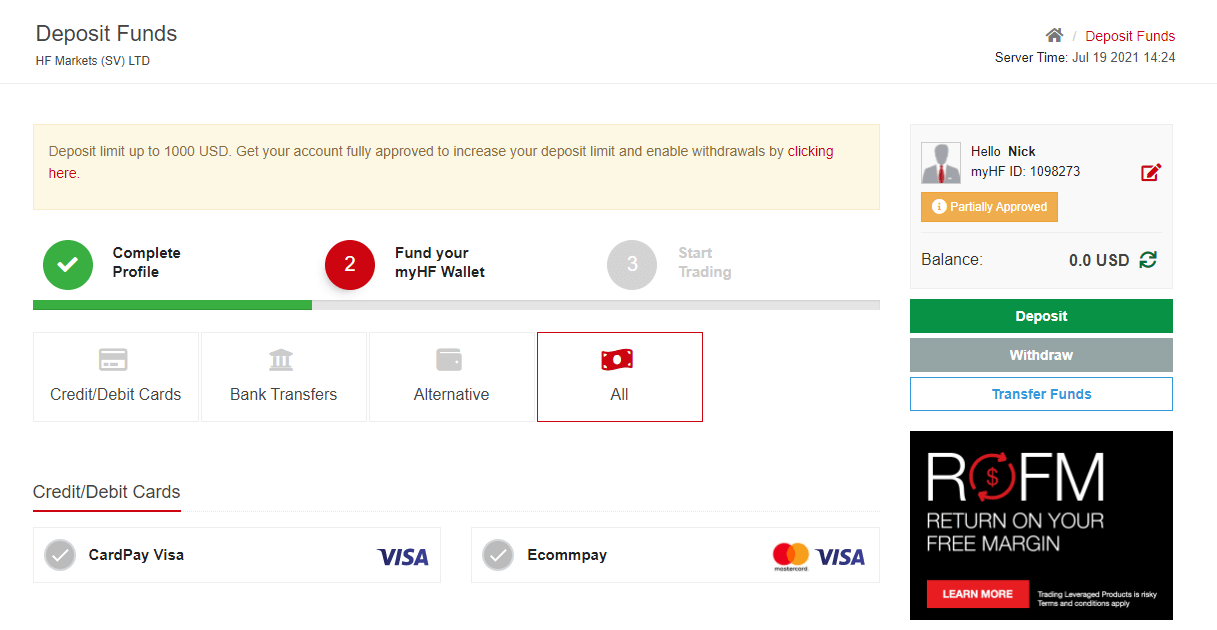

Along with that great options that allowing you to choose the most convenient option, there is a specified minimum deposit amount that is determined by the payment method you choose. So always make sure to verify this info as well, also don’t hesitate to consult HFM customer support and define all issues according to an entity or regulatory rules etc.

- Typically you can top-up account from 5$

- Fast transactions 24/5 during the standard trading hours.

- Deposit Fees: HFM does not apply any deposit fees.

How do I Deposit?

1. Login to myHF area and then press “Deposit"

2. Choose a suitable payment system and click on it.

3. Choose the currency, type the amount of money you want to deposit and press "Deposit"

4. Enter your Bank Card Detaild as needed and press "Pay"

5. Deposit Successfully

Transaction Processing and Security of Funds

- Deposits are credited to myWallet only. To transfer funds to your trading account please proceed with an Internal Transfer from myWallet.

- The Company is not liable for potential losses that may occur as a result of market moves during the time your deposit is being approved.

- HFM does not collect store or process any personal credit or debit card information

All payment transactions are processed through our independent international payment processors.- HFM shall not accept deposits from any third party to the Customers account.

- HFM does not accept cheque payments.

- Deposits are processed 24/5 between 00:00 Server Time Monday - 00:00 Server Time Saturday.

How to Transfer Funds

After Depositing successfully, you can transfer funds your from wallet to Trading Account ans start Trading Now.

How to Trade Forex in HFM

How to place a new Order in HFM MT4

1. Once you open the application, youll see a login form, which you need to complete using your login and password. Choose the Real server to log into your real account and the Demo server for your demo account.

2. Please note that every time you open a new account, we will send you an email containing that accounts login (account number) and password.

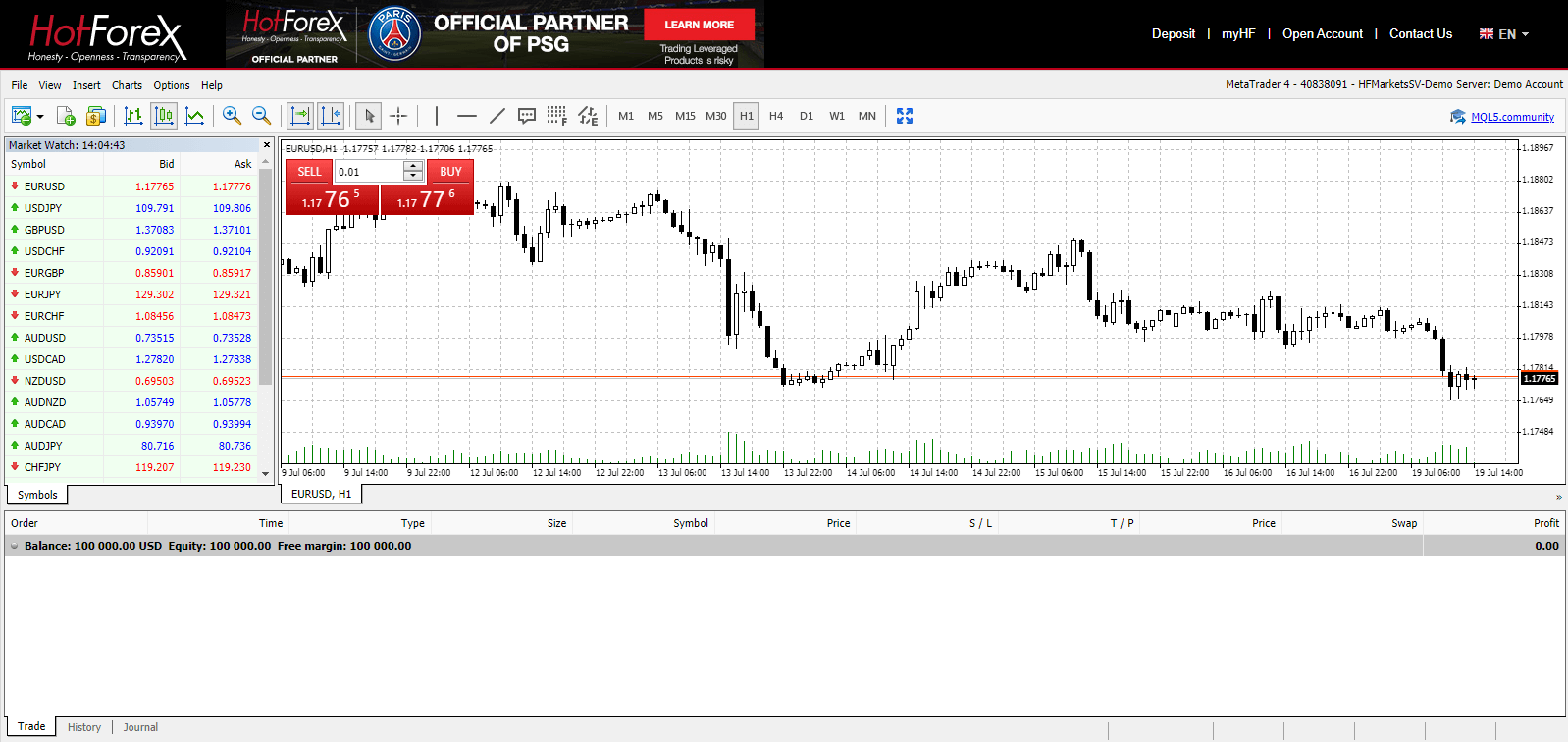

After logging in, youll be redirected to the MetaTrader platform. You will see a big chart representing a particular currency pair.

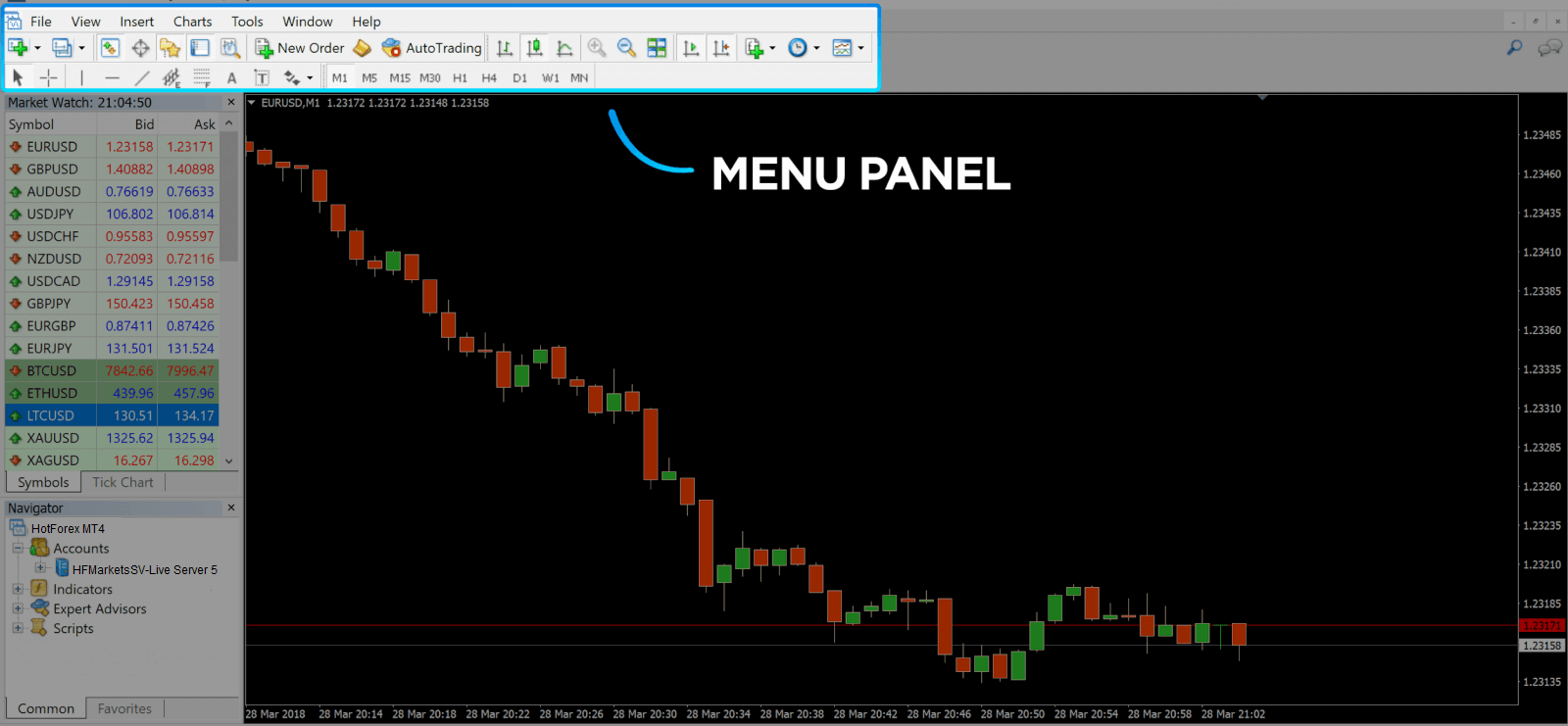

3. At the top of the screen, youll find a menu and a toolbar. Use the toolbar to create an order, change time frames and access indicators.

MetaTrader 4 Menu Panel

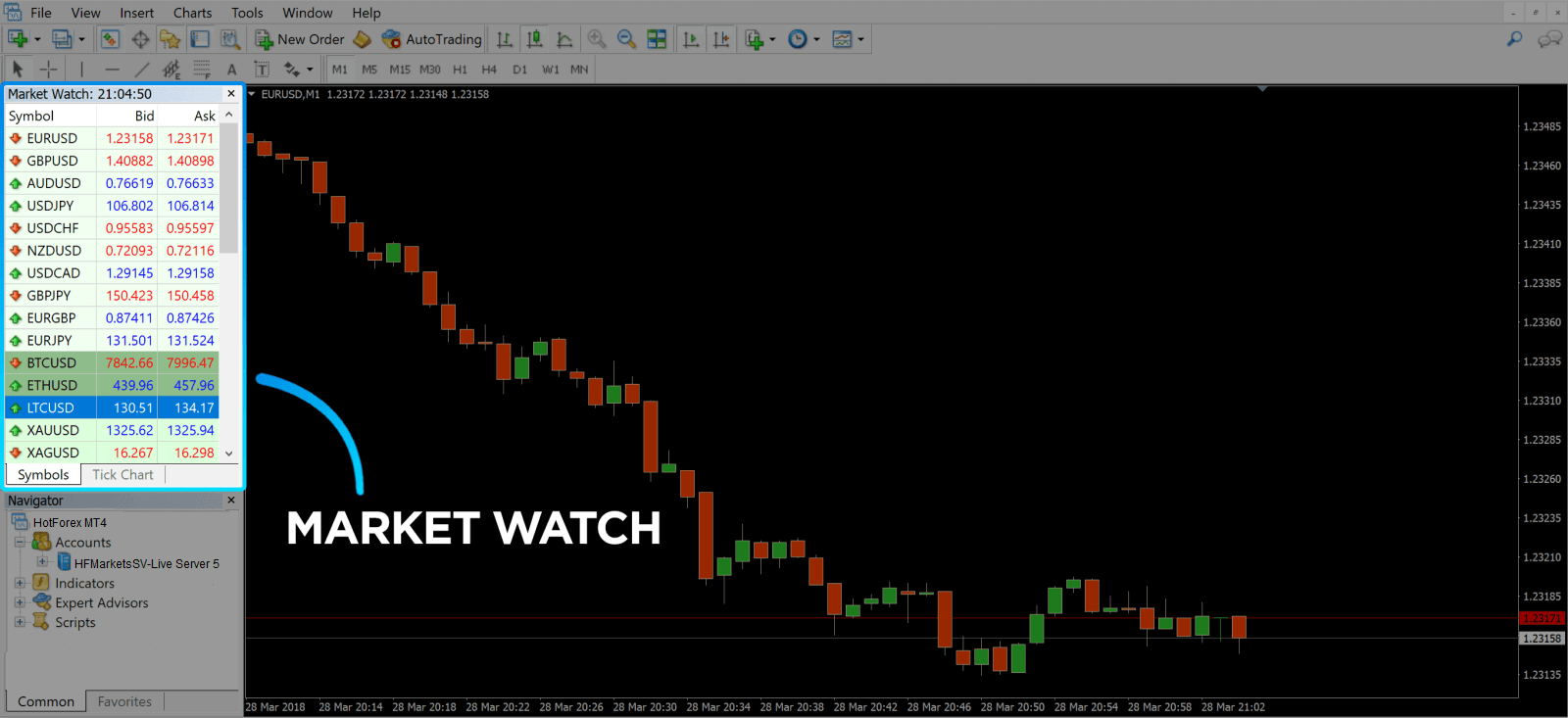

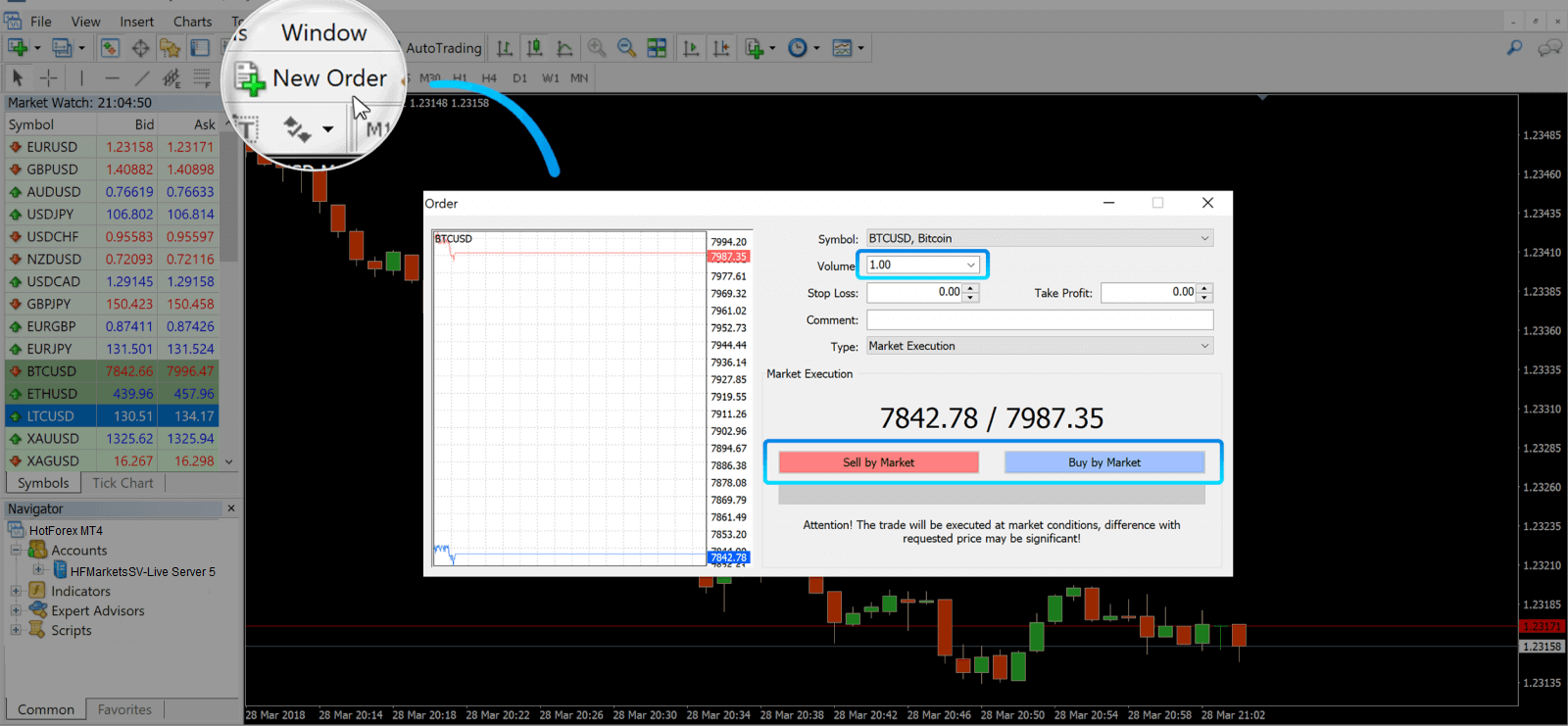

4. Market Watch can be found on the left side, which lists different currency pairs with their bid and ask prices.

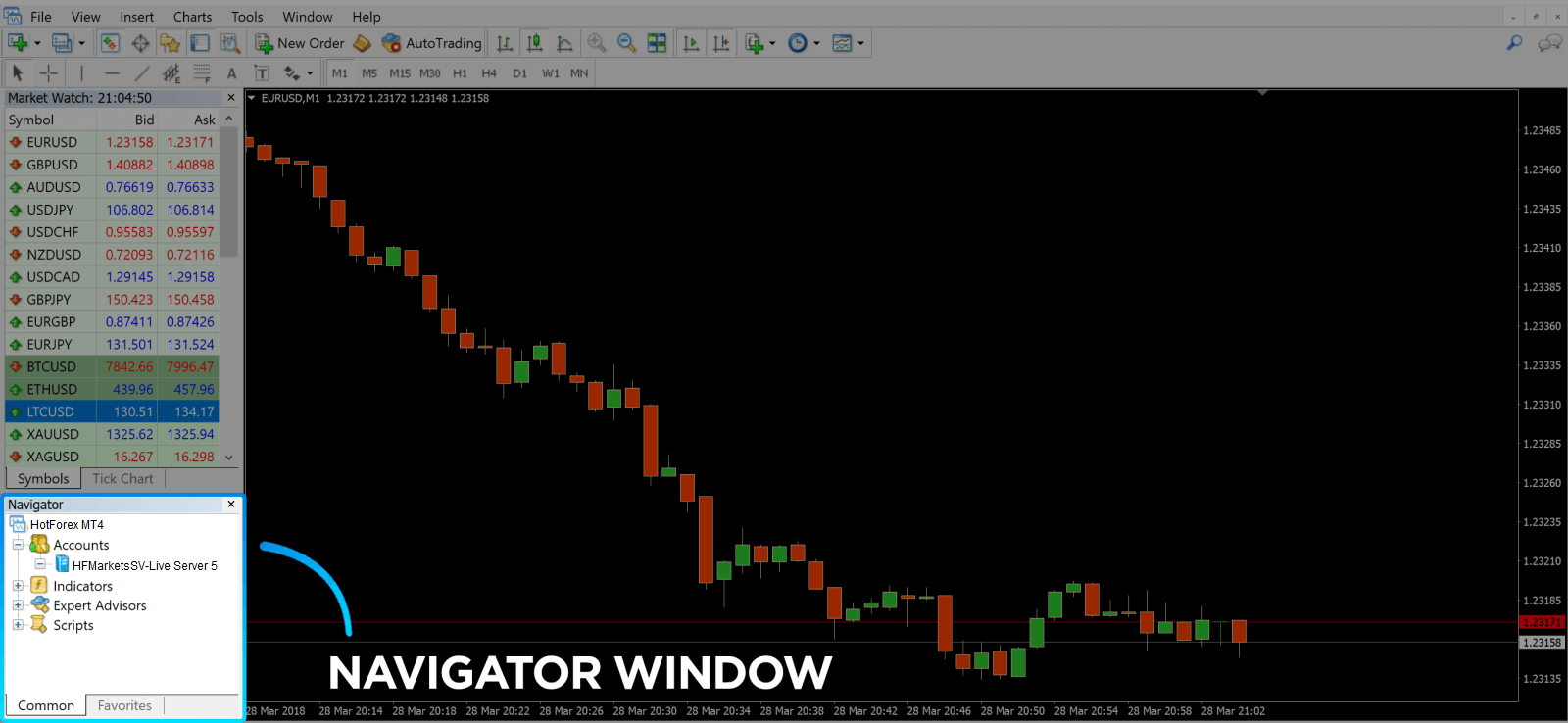

5. The ask price is used to buy a currency, and the bid is for selling. Below the ask price, youll see the Navigator, where you can manage your accounts and add indicators, expert advisors, and scripts.

MetaTrader Navigator

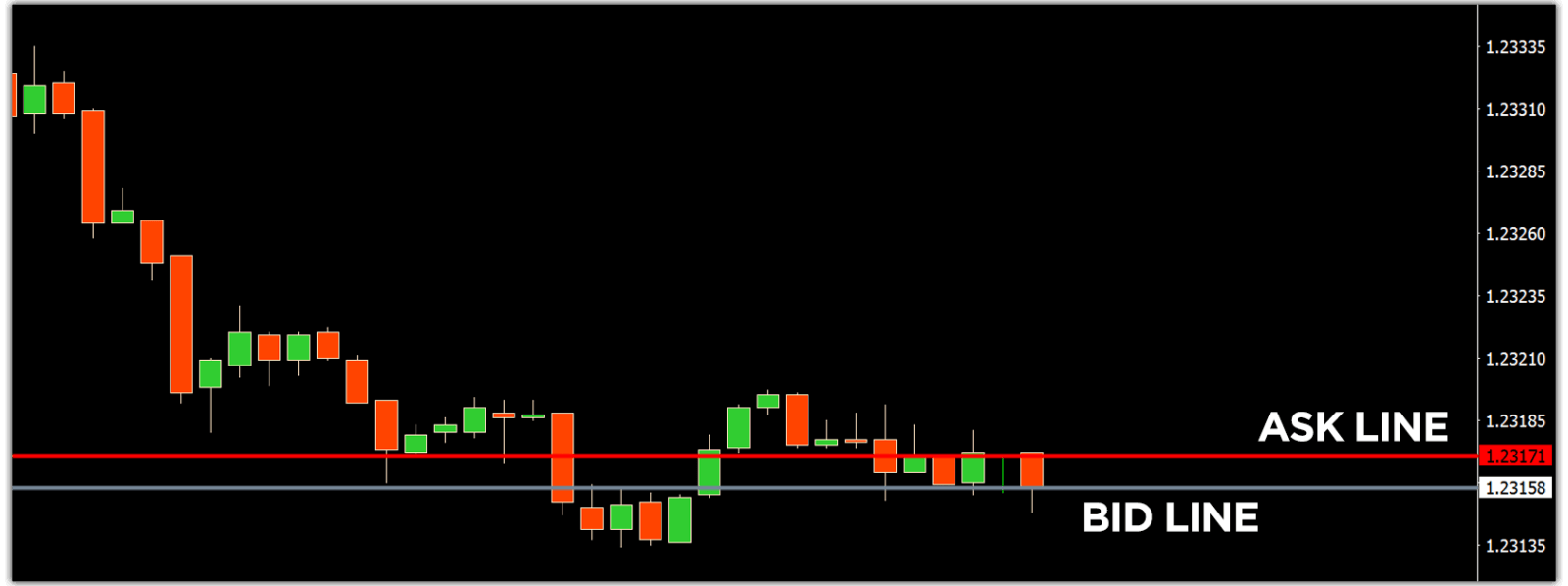

MetaTrader 4 Navigator for ask and bid lines

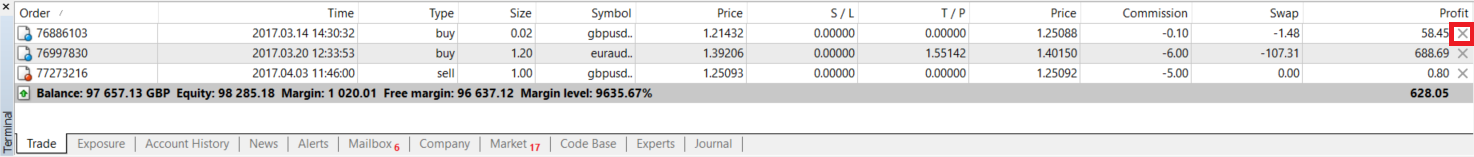

6. At the bottom of the screen can be found the Terminal, which has several tabs to help you keep track of the most recent activities, including Trade, Account History, Alerts, Mailbox, Experts, Journal, and so forth. For instance, you can see your opened orders in the Trade tab, including the symbol, trade entry price, stop loss levels, take profit levels, closing price, and profit or loss. The Account History tab collects data from activities that have happened, including closed orders.

7. The chart window indicates the current state of the market and the ask and bid lines. To open an order, you need to press the New Order button in the toolbar or press the Market Watch pair and select New Order.

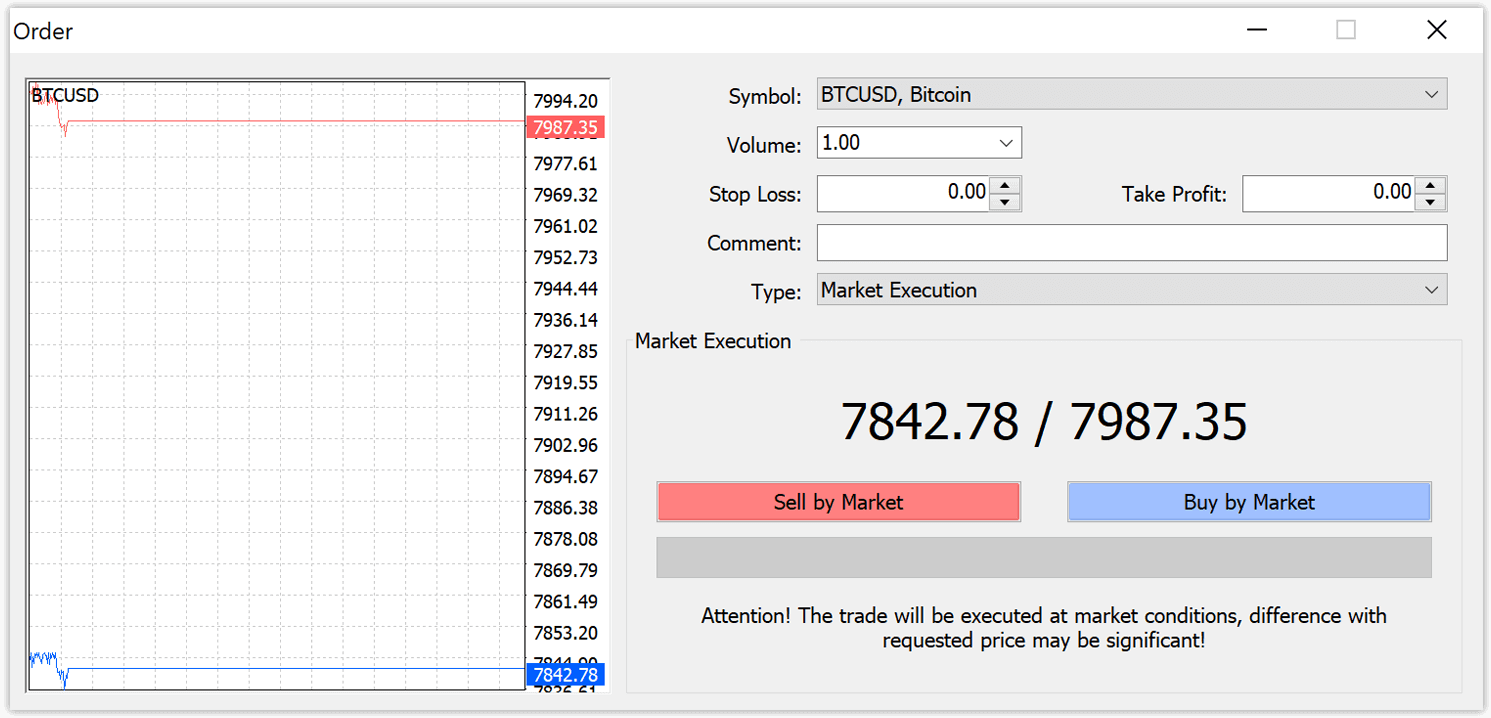

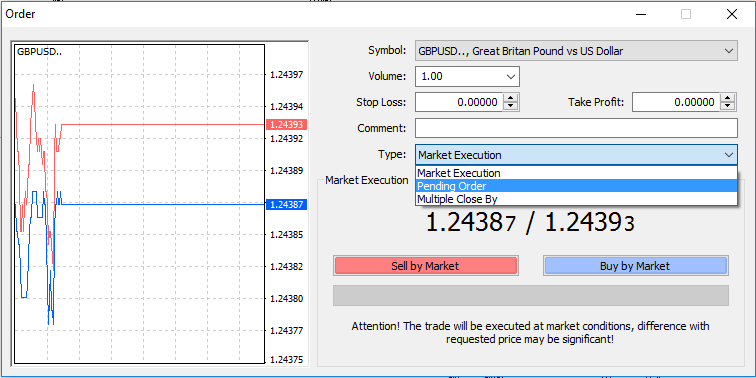

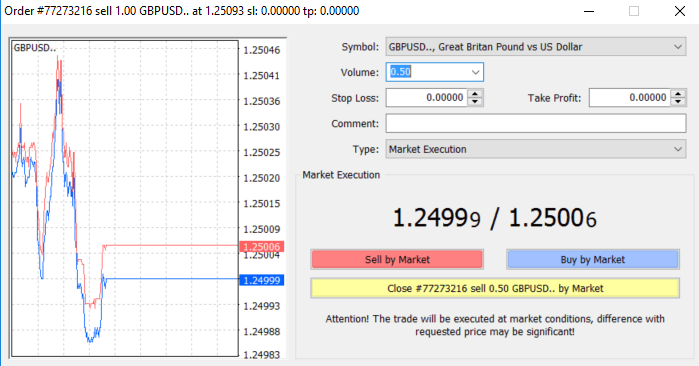

In the window that opens, you’ll see:

- Symbol, automatically set to the trading asset presented on the chart. To choose another asset, you need to select one from the drop-down list. Learn more about Forex trading sessions.

- Volume, which represents the lot size. 1.0 is equal to 1 lot or 100,000 units—profit Calculator from HFM.

- You can set Stop Loss and Take Profit at once or modify the trade later.

- The type of order can be either Market Execution (a market order) or Pending Order, where the trader can specify the desired entry price.

- To open a trade you need to click on either the Sell by Market or Buy by Market buttons.

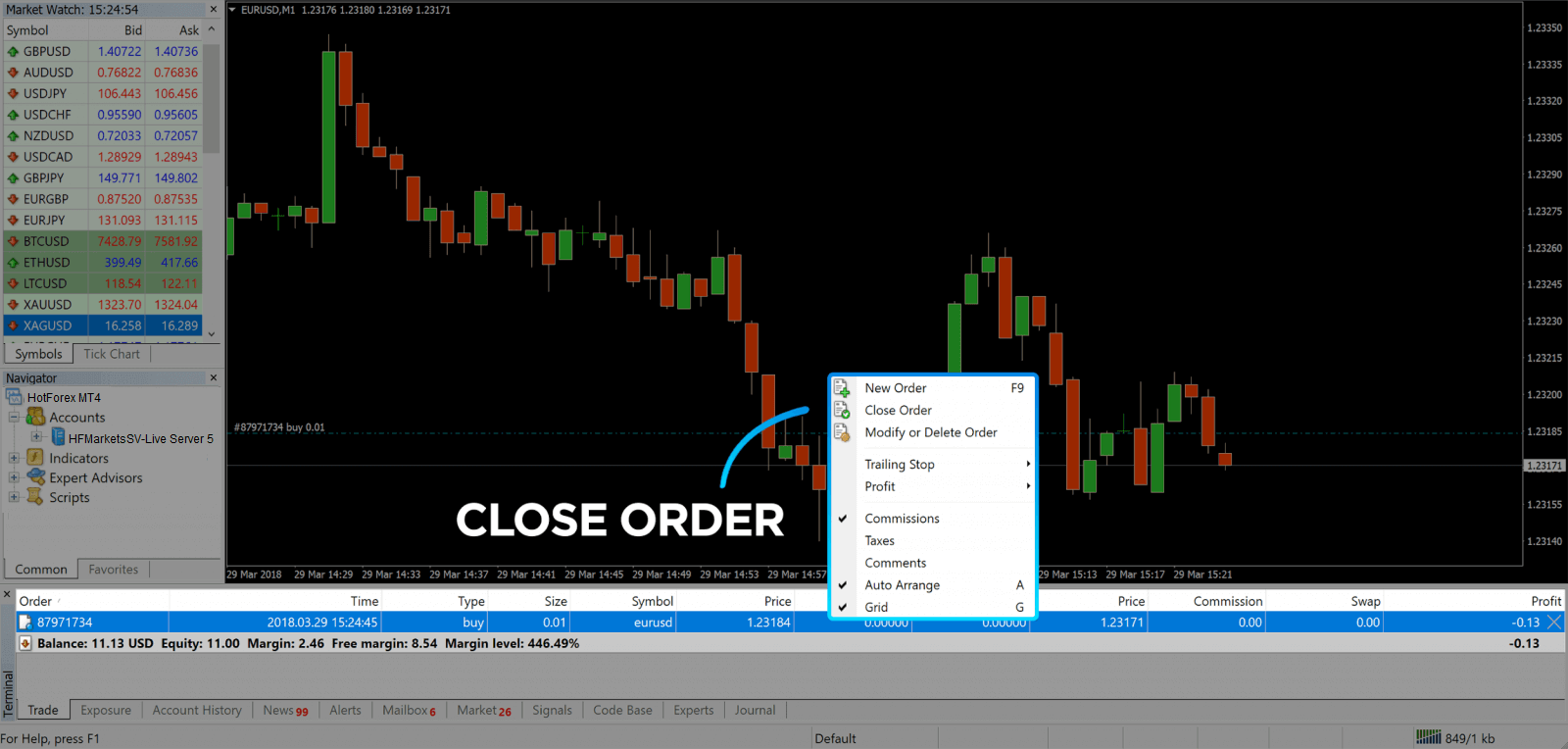

- Buy orders open by the ask price (red line) and close by the bid price (blue line). Traders buy for less and want to sell for more. Sell orders open by the bid price and close by the ask price. You sell for more and want to buy for less. You can view the opened order in the Terminal window by pressing on the Trade tab. To close the order, you need to press the order and select Close Order. You can view your closed orders under the Account History tab.

This way, you can open a trade on MetaTrader 4. Once you know each buttons purpose, itll be easy for you to trade on the platform. MetaTrader 4 offers you plenty of technical analysis tools that help you trade like an expert on the Forex market.

How to place a Pending Orders

How Many Pending Orders in HFM MT4

Unlike instant execution orders, where a trade is placed at the current market price, pending orders allow you to set orders that are opened once the price reaches a relevant level, chosen by you. There are four types of pending orders available , but we can group them to just two main types:

- Orders expecting to break a certain market level

- Orders expecting to bounce back from a certain market level

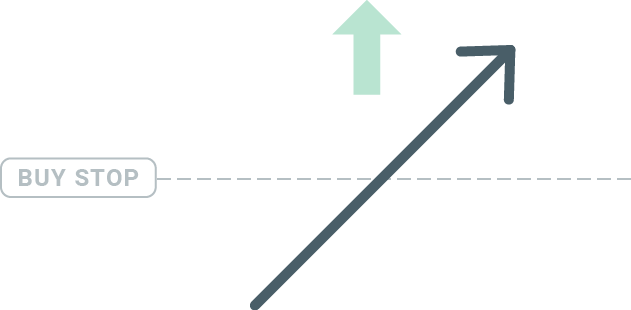

Buy Stop

The Buy Stop order allows you to set a buy order above the current market price. This means that if the current market price is $20 and your Buy Stop is $22, a buy or long position will be opened once the market reaches that price.

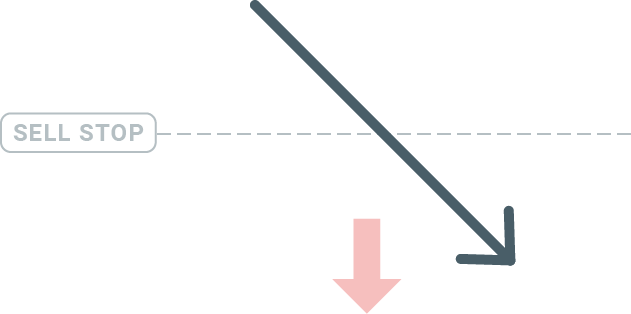

Sell Stop

The Sell Stop order allows you to set a sell order below the current market price. So if the current market price is $20 and your Sell Stop price is $18, a sell or ‘short’ position will be opened once the market reaches that price.

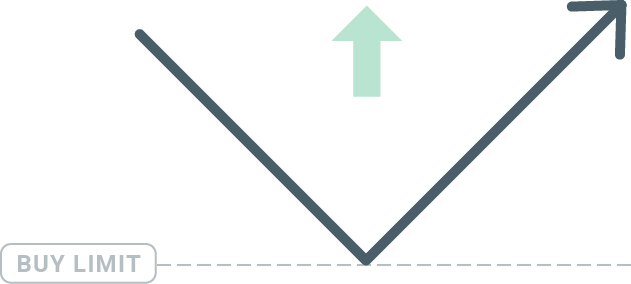

Buy Limit

The opposite of a buy stop, the Buy Limit order allows you to set a buy order below the current market price. This means that if the current market price is $20 and your Buy Limit price is $18, then once the market reaches the price level of $18, a buy position will be opened.

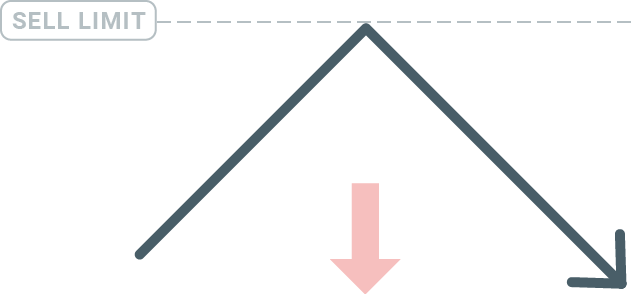

Sell Limit

Finally, the Sell Limit order allows you to set a sell order above the current market price. So if the current market price is $20 and the set Sell Limit price is $22, then once the market reaches the price level of $22, a sell position will be opened on this market.

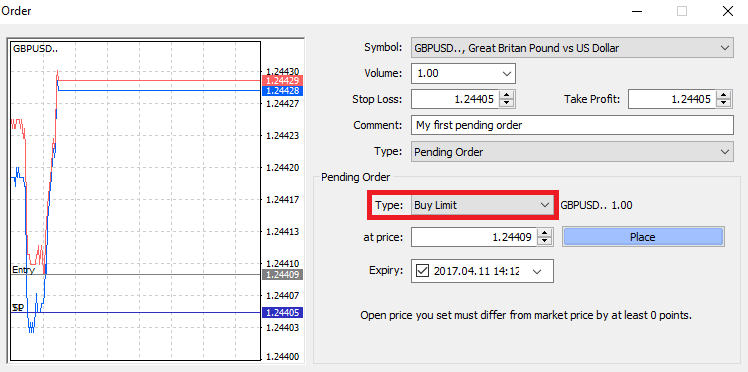

Opening Pending Orders

You can open a new pending order simply by double-clicking on the name of the market on the Market Watch module. Once you do so, the new order window will open and you will be able to change the order type to Pending order.

Next, select the market level at which the pending order will be activated. You should also choose the size of the position based on the volume.

If necessary, you can set an expiration date (‘Expiry’). Once all these parameters are set, select a desirable order type depending on whether you would like to go long or short and stop or limit and select the ‘Place’ button.

As you can see, pending orders are very powerful features of MT4. They are most useful when youre not able to constantly watch the market for your entry point, or if the price of an instrument changes quickly, and you don’t want to miss the opportunity.

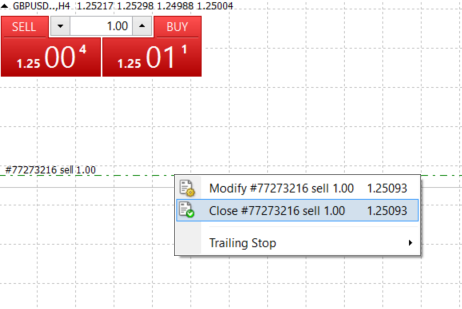

How to close Orders in HFM MT4

To close an open position, click the ‘x’ in the Trade tab in the Terminal window.

Or right-click the line order on the chart and select ‘close’.

If you’d like to close only a part of position, click the right-click on the open order and select ‘Modify’. Then, in the Type field, select instant execution and choose what part of the position you want to close.

As you can see, opening and closing your trades on MT4 is very intuitive, and it literally takes just one click.

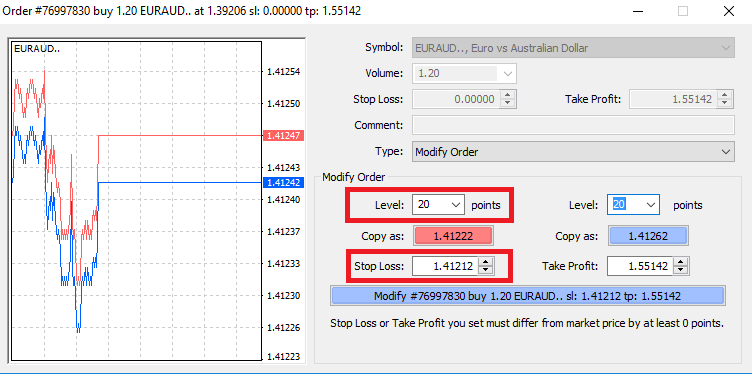

Using Stop Loss, Take Profit and Trailing Stop in HFM MT4

One of the keys to achieving success in financial markets over the long term is prudent risk management. That’s why stop losses and take profits should be an integral part of your trading.

So let’s have a look how to use them on our MT4 platform to ensure you know how to limit your risk and maximise your trading potential.

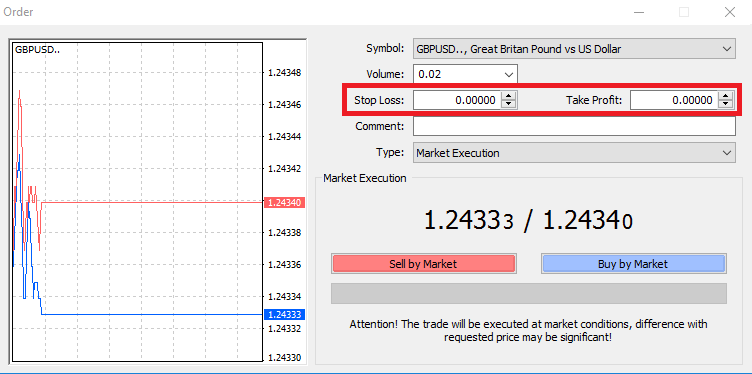

Setting Stop Loss and Take Profit

The first and the easiest way to add Stop Loss or Take Profit to your trade is by doing it right away, when placing new orders.

To do this, simply enter your particular price level in Stop Loss or Take Profit fields. Remember that Stop Loss will be executed automatically when the market moves against your position (hence the name: stop losses), and Take Profit levels will be executed automatically when the price reaches your specified profit target. This means that you’re able to set your Stop Loss level below the current market price and Take Profit level above current market price.

It’s important to remember that a Stop Loss (SL) or a Take Profit (TP) is always connected to an open position or a pending order. You can adjust both once your trade has been opened and you’re monitoring the market. It’s a protective order to your market position, but of course they are not necessary to open a new position. You always can add them later, but we highly recommend to always protect your positions*.

Adding Stop Loss and Take Profit Levels

The easiest way to add SL/TP levels to your already opened position is by a using trade line on the chart. To do so, simply drag and drop the trade line up or down to specific level.

Once you’ve entered SL/TP levels, the SL/TP lines will appear on the chart. This way you can also modify SL/TP levels simply and quickly.

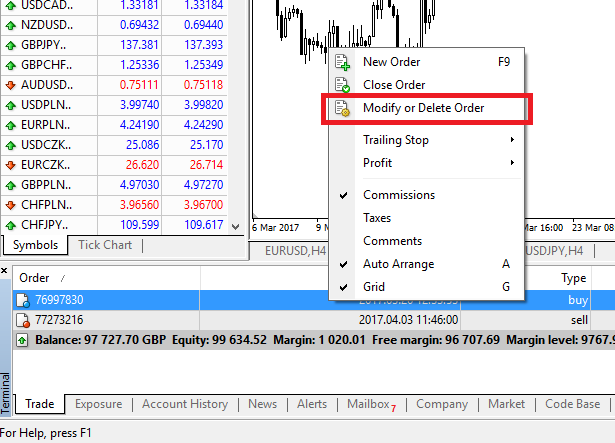

You can also do this from the bottom ‘Terminal’ module as well. To add or modify SL/TP levels, simply right-click on your open position or pending order, and choose ‘Modify or delete order’.

The order modification window will appear and now you’re able to enter/modify SL/TP by the exact market level, or by defining the points range from the current market price.

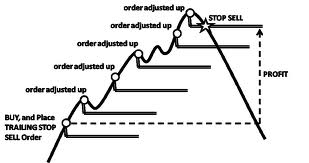

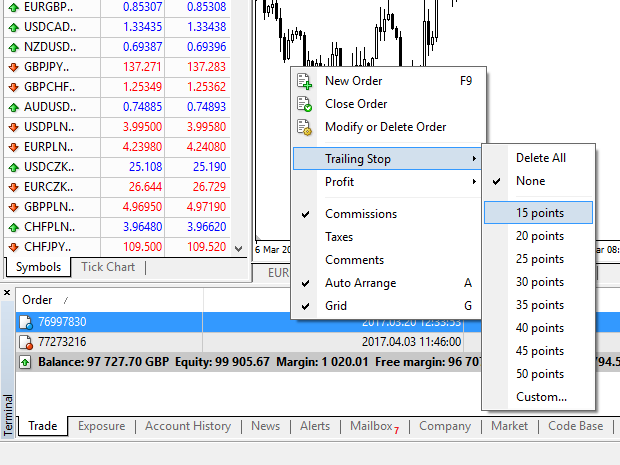

Trailing Stop

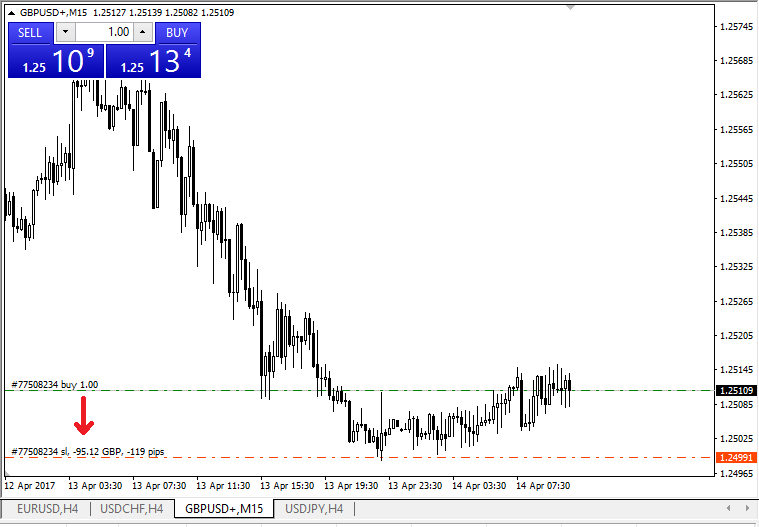

Stop Losses are intended for reducing losses when the market moves against your position, but they can help you lock in your profits as well.While that may sound a bit counterintuitive at first, its actually very easy to understand and master.

Let’s say you’ve opened a long position and the market moves in the right direction, making your trade a profitable one at present. Your original Stop Loss, which was placed at a level below your open price, can now be moved to your open price (so you can break even) or above the open price (so you are guaranteed a profit).

To make this process automatic, you can use a Trailing Stop. This can be a really useful tool for your risk management, particularly when price changes are rapid or when you’re unable to constantly monitor the market.

As soon as the position turns profitable, your Trailing Stop will follow the price automatically, maintaining the previously established distance.

Following the example above, please bear in mind, however, that your trade needs to be running a profit large enough for the Trailing Stop to move above your open price, before your profit can be guaranteed.

Trailing Stops (TS) are attached to your opened positions, but it’s important to remember that if you have a trailing stop on MT4, you need to have the platform open for it to be successfully executed.

To set a Trailing Stop, right-click the open position in the ‘Terminal’ window and specify your desired pip value of distance between the TP level and the current price in the Trailing Stop menu.

Your Trailing Stop is now active. This means that if prices change to the profitable market side, TS will ensure the stop loss level follows the price automatically.

Your Trailing Stop can easily be disabled by setting ‘None’ in the Trailing Stop menu. If you want to quickly deactivate it in all opened positions, just select ‘Delete All’.

As you can see, MT4 provides you with plenty of ways to protect your positions in just a few moments.

*Whilst Stop Loss orders are one of the best ways to ensure your risk is managed and potential losses are kept to acceptable levels, they don’t provide 100% security.

Stop losses are free to use and they protect your account against adverse market moves, but please be aware that they cannot guarantee your position every time. If the market becomes suddenly volatile and gaps beyond your stop level (jumps from one price to the next without trading at the levels in between), it’s possible your position could be closed at a worse level than requested. This is known as price slippage.

Guaranteed stop losses, which have no risk of slippage and ensure the position is closed out at the Stop Loss level you requested even if a market moves against you, are available for free with a basic account.

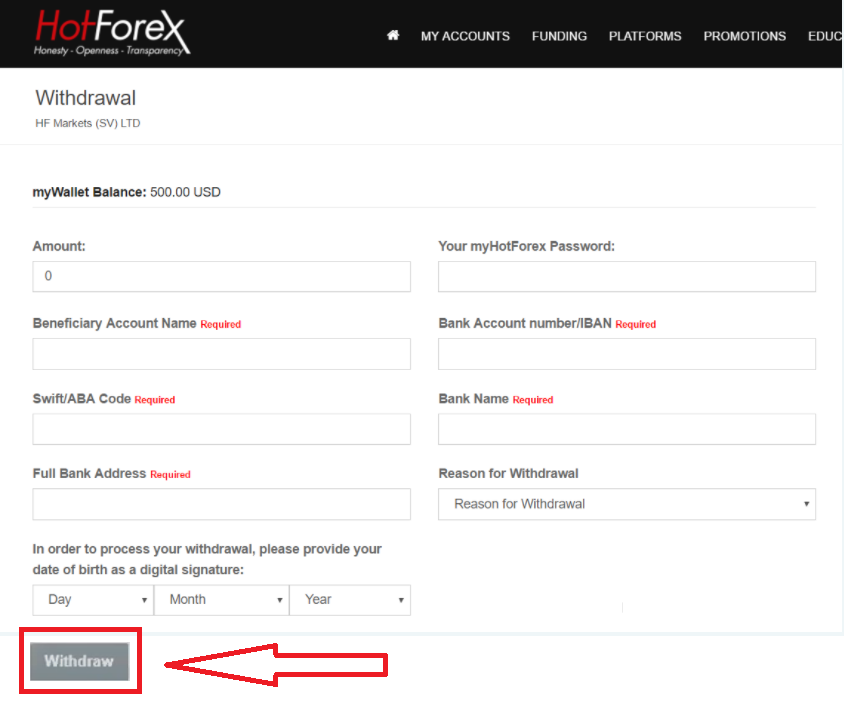

How to Withdraw Funds from HFM

Withdrawal methods

You can withdraw at any time from the funds that are surplus to any margin requirement. To request a withdrawal, simply login to myHF area (your Client Area) and select Withdraw. Withdrawals submitted before 10:00am server time are processed on the same business day between 7:00am and 5:00pm server time.

Withdrawals submitted after 10:00am server time, will be processed on the following business day between 7:00am and 5:00pm server time.

* HFM does not charge for bank wire transactions. However, the sending, correspondent and receiving bank may charge according to their own fee structure.

For debit cards, we cannot process withdrawal amounts that exceed the initial deposit or sum of all debit card deposits. In case your withdrawal amount exceeds your initial deposit or the sum of all deposits by credit card, you will be entitled to receive the difference by wire transfer. For any further questions regarding your funds withdrawal, please contact our back office on [email protected].

How can I withdraw money?

Withdrawals are available from myWallet only. To withdraw funds from your trading account, you can proceed with an Internal Transfer to myWallet. HFM will not be responsible for any errors made by the account holder. In order to complete the withdrawal request, you must fill out all fields just like the picture below.

1. Login to myHF area (your Client area), press "Withdraw"

2. Choose a suitable payment system and click on it.

3. Type all the required infor, the amount of money you want to withdraw and press "Withdraw"

In the first 6 months, you have to withdrawal the same way you deposit. If you deposit via your VISA card, you have to withdraw money back to that VISA card. If you use multiple deposit methods, the amount you can withdraw is based on the ratio between the amounts you deposited.

For example, if you deposit $50 via VISA and $100 via Skrill, you can withdraw only a third of your balance to your VISA card. The rest has to be withdrawn to your Skrill account.

You have to indentify your information if you want to make withdrawals.

Frequently Asked Questions (FAQ) of HFM

Is HFM regulated?

HFM is a unified brand name of the HF Markets Group which encompasses the following entities:

- HF Markets (SV) Ltd incorporated in St. Vincent the Grenadine as an International Business Company with the registration number 22747 IBC 2015

- HF Markets (Europe) Ltd a Cypriot Investment Firm (CIF) under number HE 277582. Regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 183/12.

- HF Markets SA (PTY) Ltd is an authorised Financial Service Provider from the Financial Sector Conduct Authority (FSCA) in South Africa, with authorisation number 46632.

- HF Markets (Seychelles) Ltd is regulated by the Seychelles Financial Services Authority (FSA) with Securities Dealers License number SD015.

- HF Markets (DIFC) Ltd is authorised and regulated by the Dubai Financial Services Authority (DFSA) under license number F004885.

- HF Markets (UK) Ltd is authorised and regulated by the Financial Conduct Authority (FCA) under firm reference number 801701.

Account Opening

What is the difference between a myHF account and a trading account?

Your myHF account is your wallet, which is automatically created when you register with HFM. It can be used to make deposits, withdrawals and internal transfers to and from your trading accounts. Through your myHF area you can also create your live trading accounts and demo accounts.Note: You can log in to your myHF account only from the website or using an App.

A trading account is a Live or Demo account you create through your myHF area in order to trade any asset available.

Note: You can log in to your Live / Demo trading account only on the platform or the WebTerminal.

What leverage is applied to my account?

Leverage available for HFM trading accounts is up to 1:1000 depending on the account type. For further details please go to our Account Types page on our website.

Deposit

What is the minimum funding requirement to open an account?

The minimum initial deposit depends on the account type selected. Please click here to view all our accounts and the minimum initial deposit for each.How can I deposit funds into my account?

We offer a variety of deposit options. Please click here to see all available methods.Withdrawal

How can I withdraw money?

- You can withdraw at any time from the funds that are surplus to any margin requirement. To request a withdrawal, simply login to myHF area (your Client Area) and select Withdraw. Withdrawals submitted before 10:00am server time are processed on the same business day between 7:00am and 5:00pm server time.

- Withdrawals submitted after 10:00am server time, will be processed on the following business day between 7:00am and 5:00pm server time.

- To see all available withdrawal options, please click here

Does HFM charge for withdrawal?

The Company does not charge any fees for deposits or withdrawals. If any fees are applied they are charged solely by the payment gateway vendor, bank or credit card company.

How much can I withdraw from my HFM account?

Should credit/ debit card deposits be received, all withdrawals up to the amount of total deposits by credit/ debit card will be processed back to the same credit/ debit card on a priority base. withdrawn to the card per month is $5000.

Trading

What is the spread?

- The spread is the difference between the bid and offer.

- To see our Forex typical spreads, click here