How to Trade Forex in HFM MT4/MT5

How to place a new Order in HFM MT4

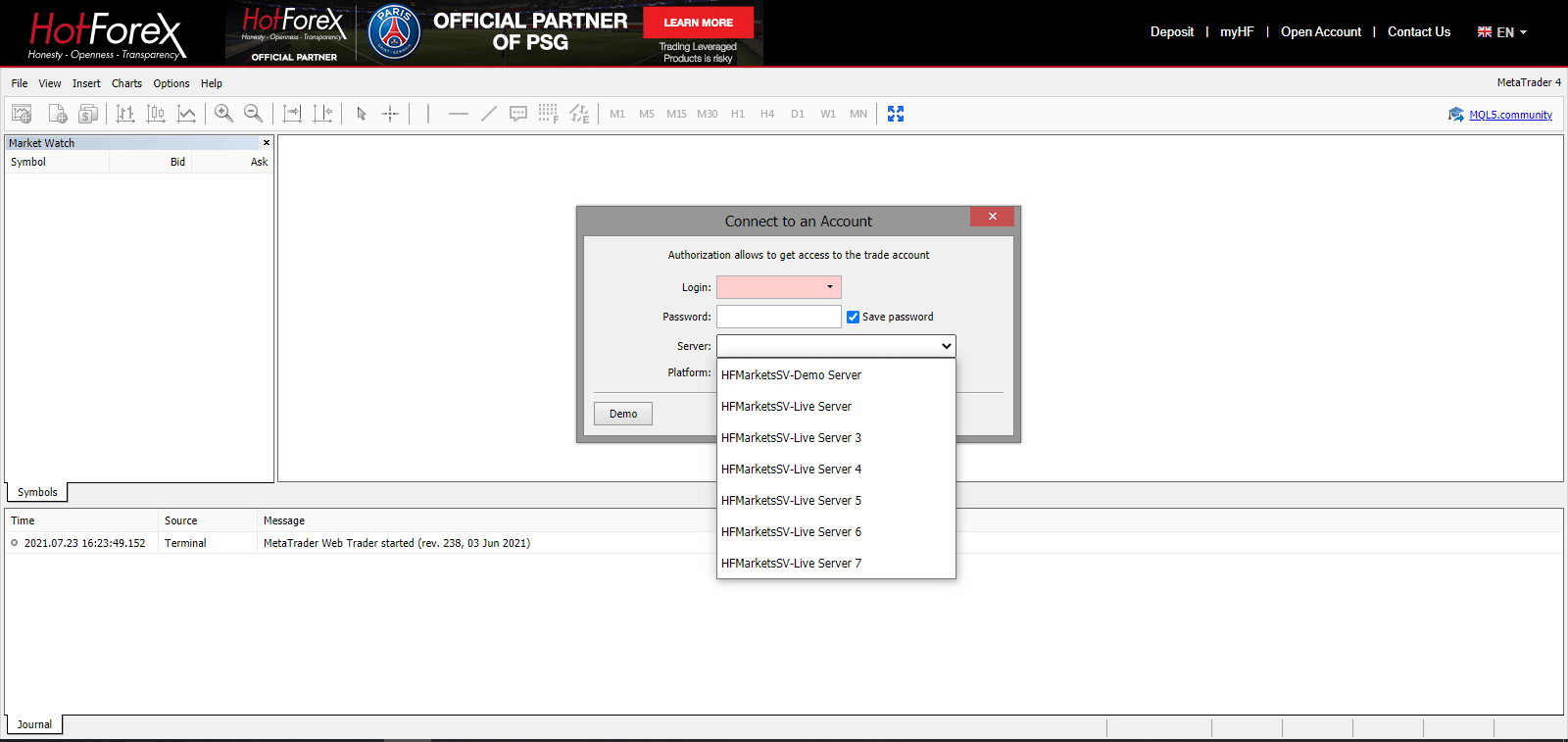

1. Once you open the application, youll see a login form, which you need to complete using your login and password. Choose the Real server to log into your real account and the Demo server for your demo account.

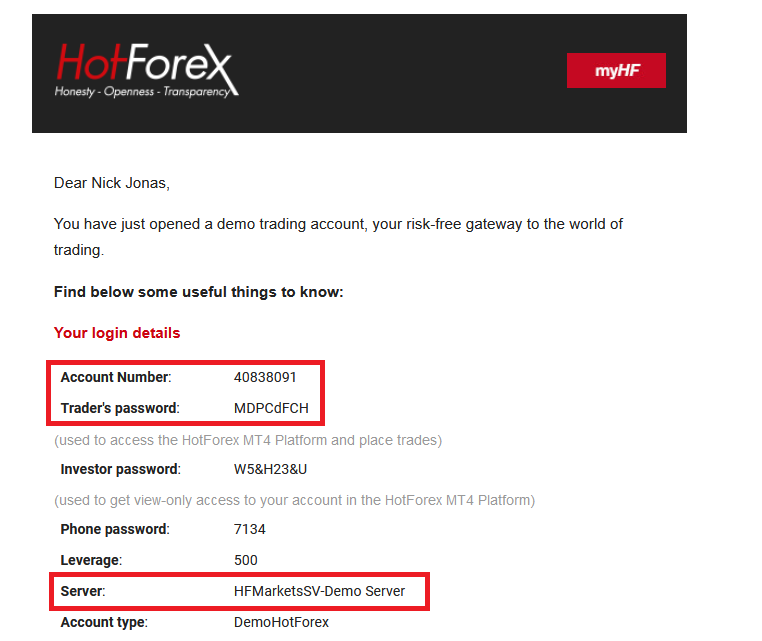

2. Please note that every time you open a new account, we will send you an email containing that accounts login (account number) and password.

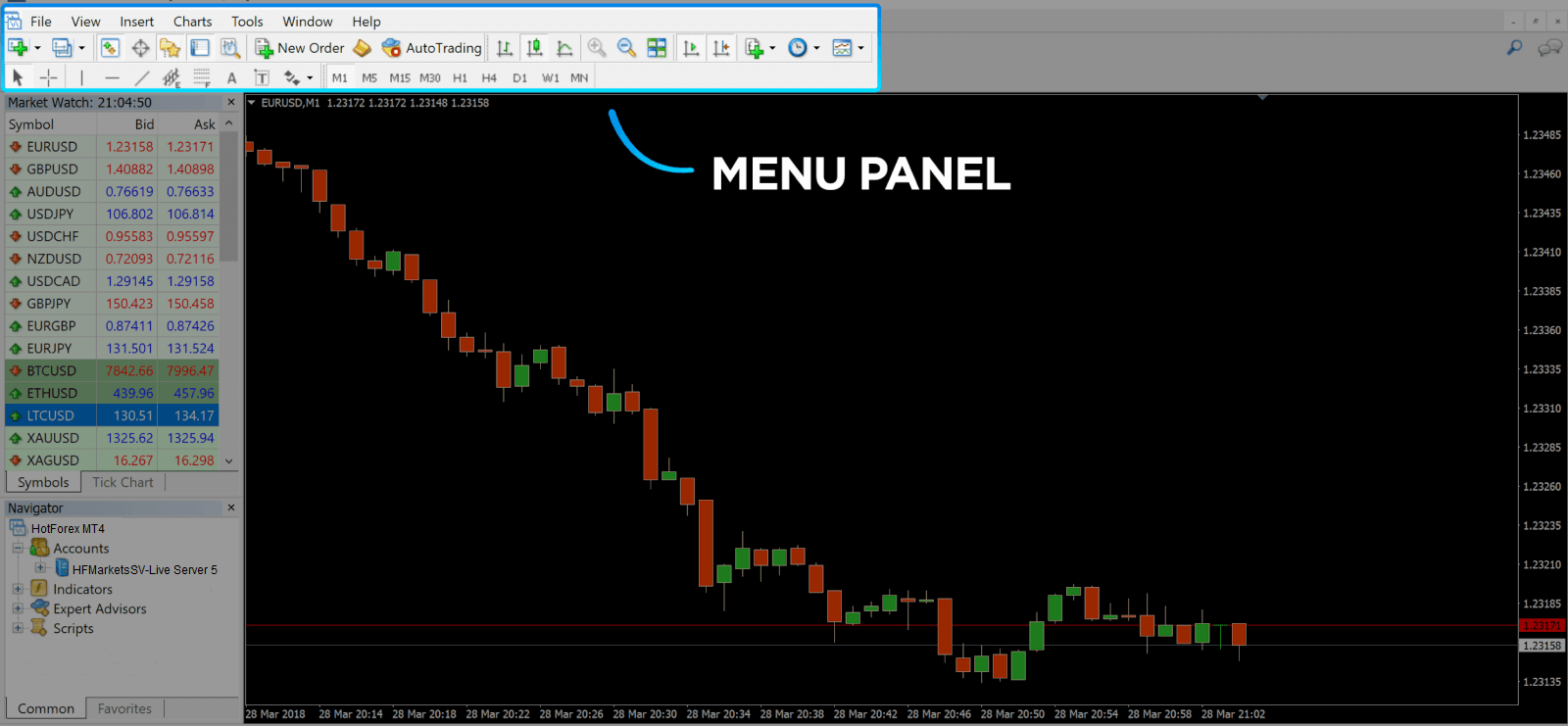

After logging in, youll be redirected to the MetaTrader platform. You will see a big chart representing a particular currency pair.

3. At the top of the screen, youll find a menu and a toolbar. Use the toolbar to create an order, change time frames and access indicators.

MetaTrader 4 Menu Panel

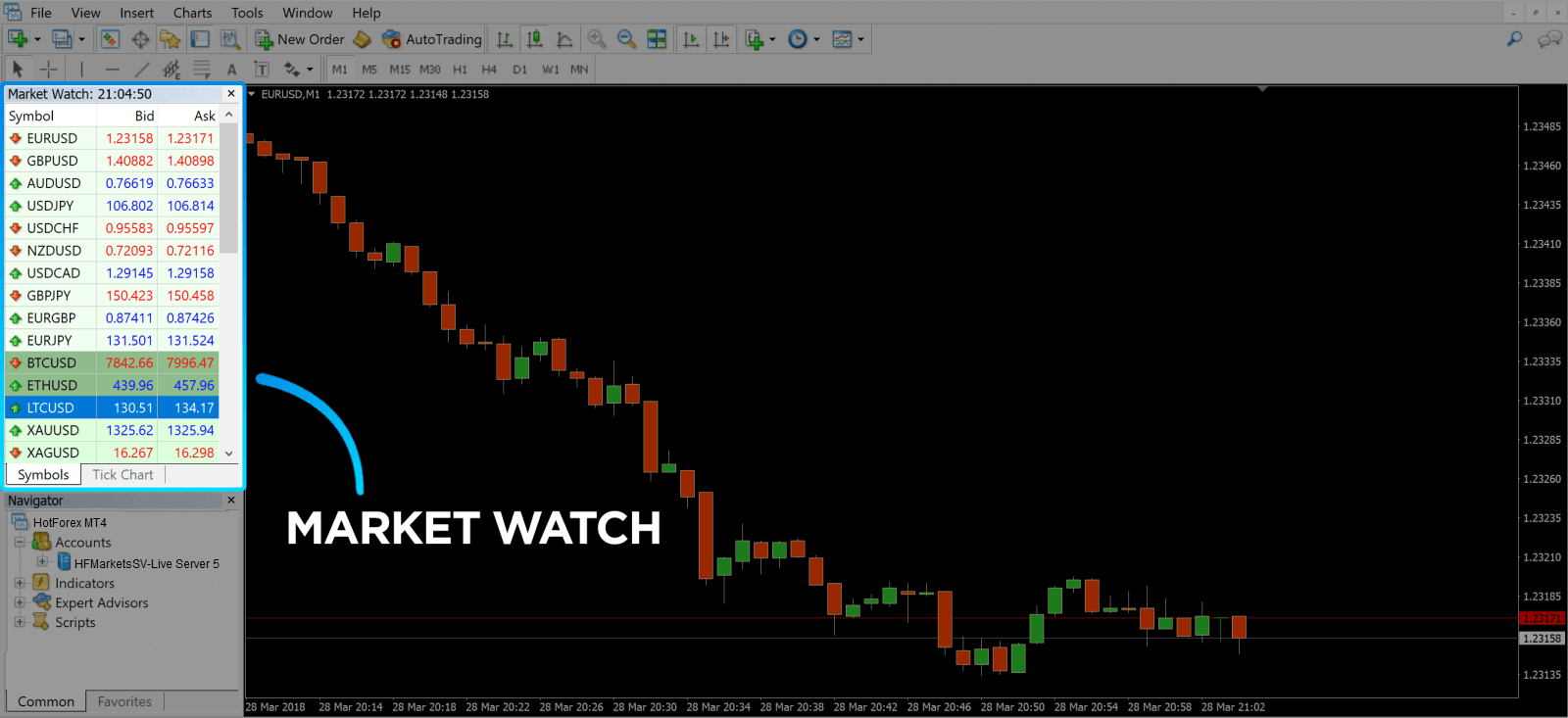

4. Market Watch can be found on the left side, which lists different currency pairs with their bid and ask prices.

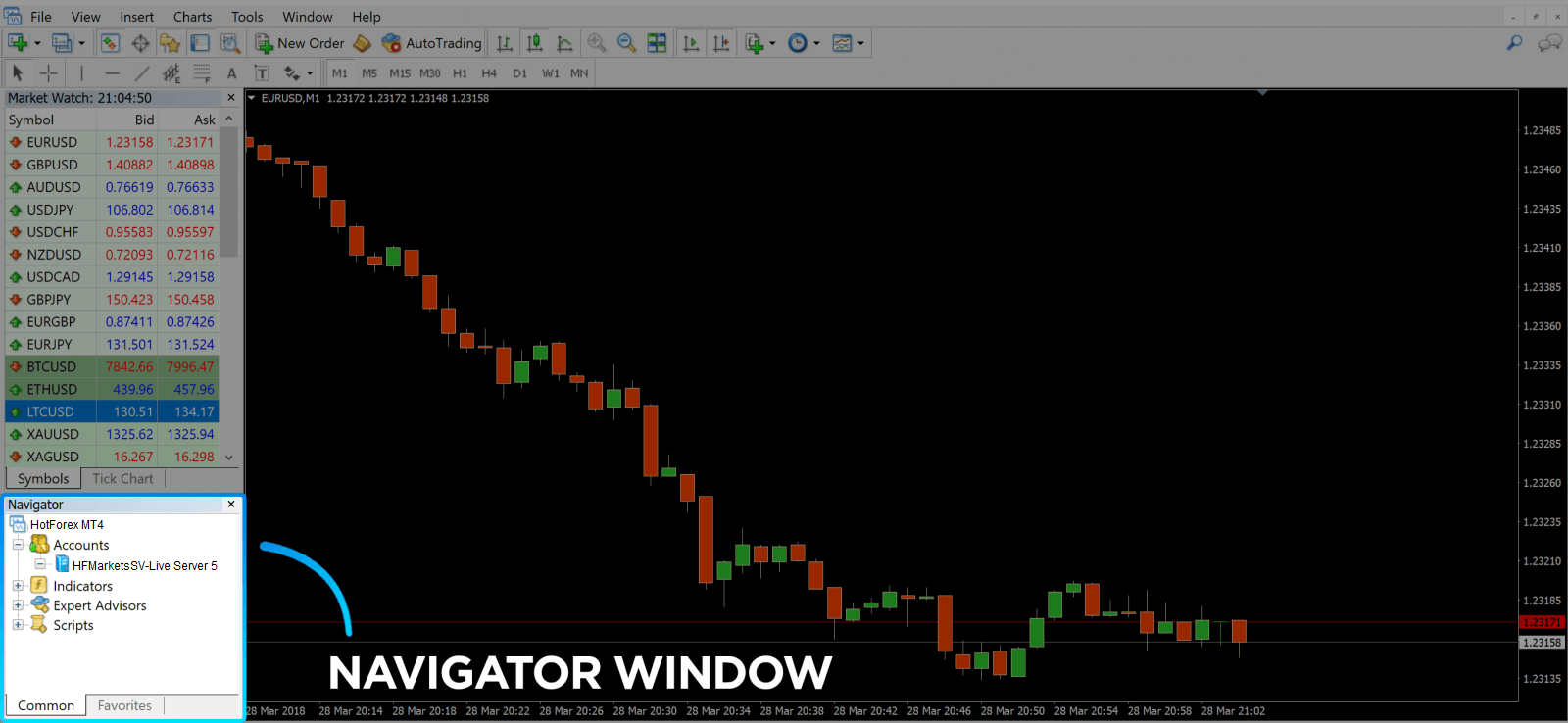

5. The ask price is used to buy a currency, and the bid is for selling. Below the ask price, youll see the Navigator, where you can manage your accounts and add indicators, expert advisors, and scripts.

MetaTrader Navigator

MetaTrader 4 Navigator for ask and bid lines

6. At the bottom of the screen can be found the Terminal, which has several tabs to help you keep track of the most recent activities, including Trade, Account History, Alerts, Mailbox, Experts, Journal, and so forth. For instance, you can see your opened orders in the Trade tab, including the symbol, trade entry price, stop loss levels, take profit levels, closing price, and profit or loss. The Account History tab collects data from activities that have happened, including closed orders.

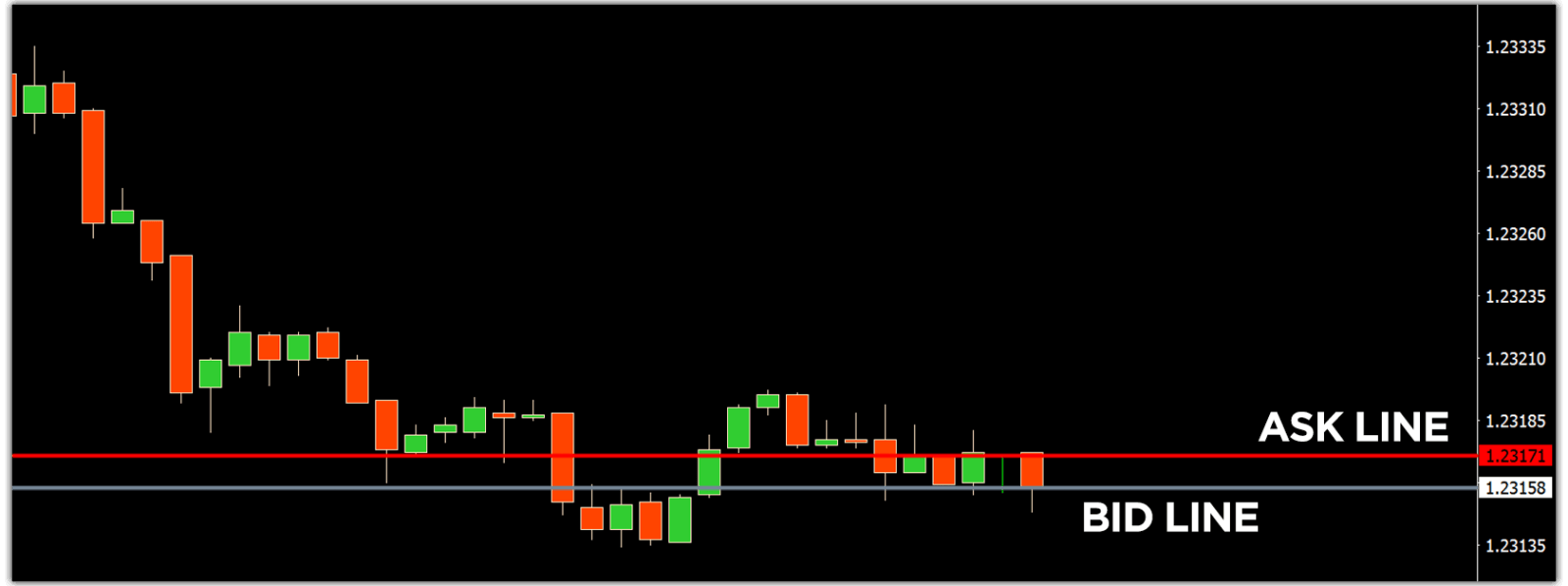

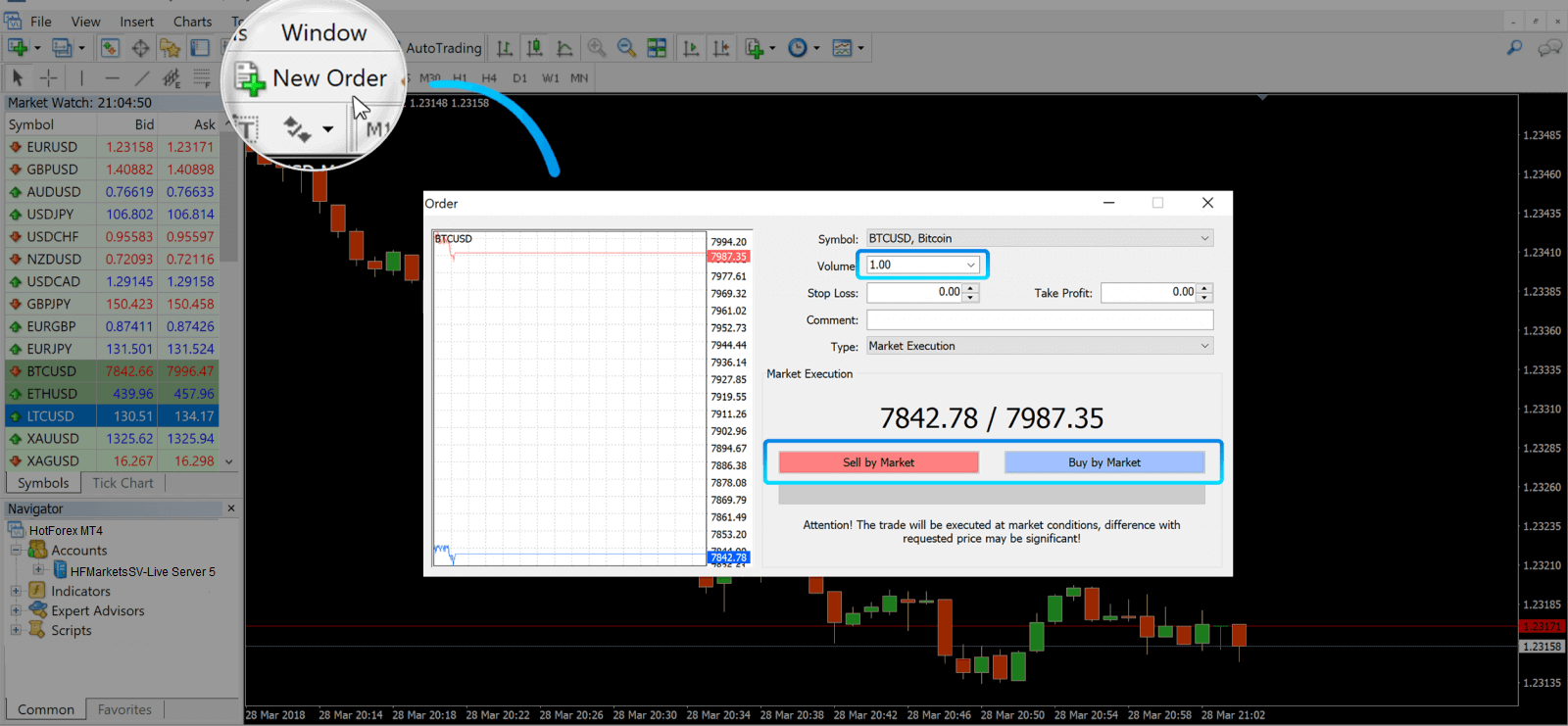

7. The chart window indicates the current state of the market and the ask and bid lines. To open an order, you need to press the New Order button in the toolbar or press the Market Watch pair and select New Order.

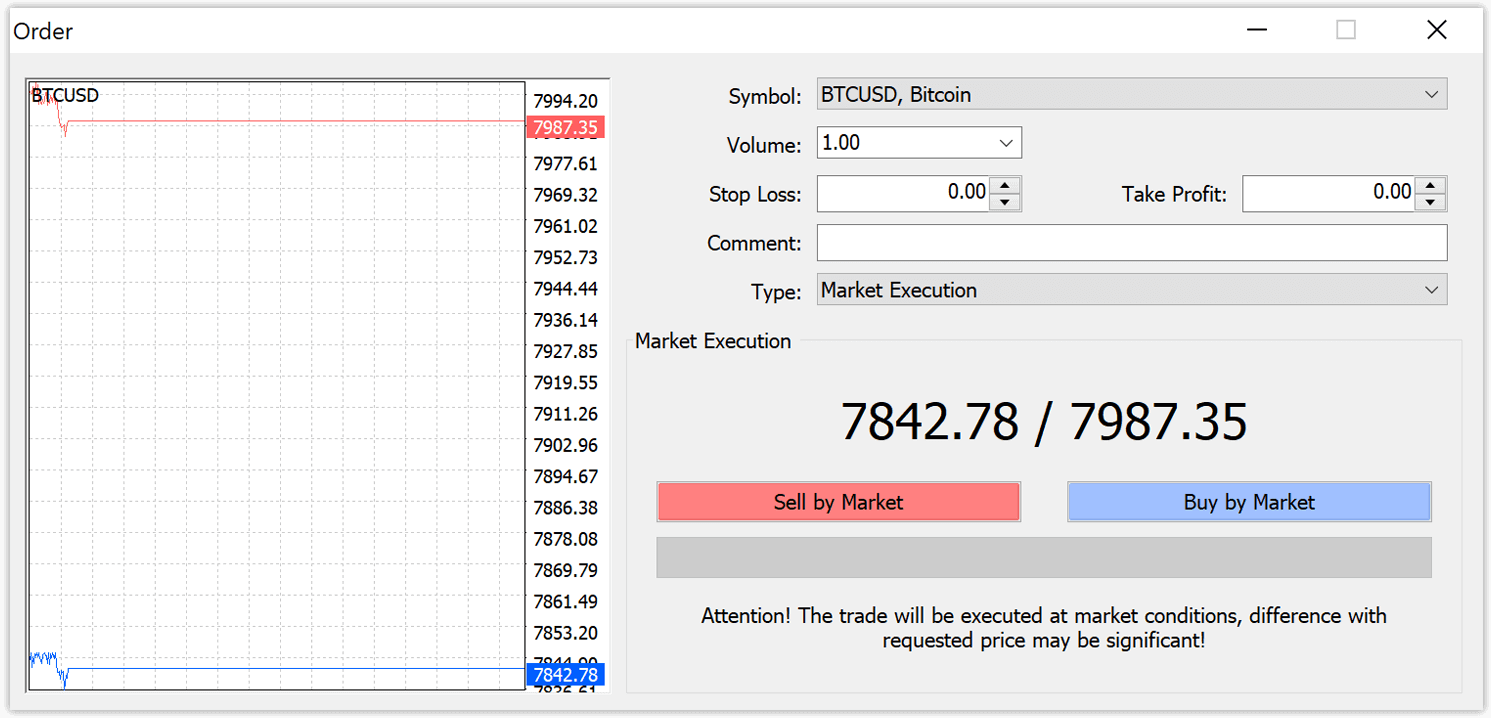

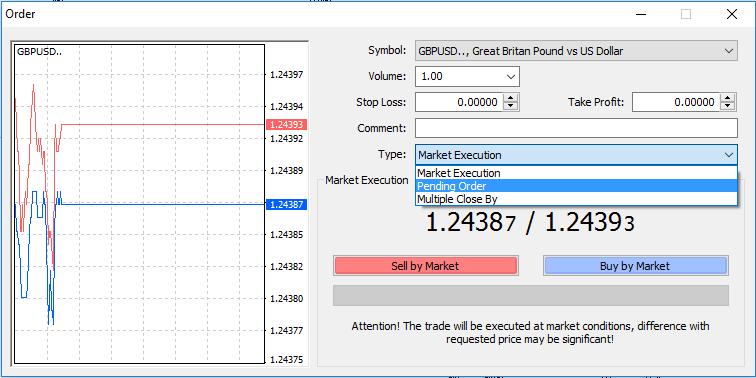

In the window that opens, you’ll see:

- Symbol, automatically set to the trading asset presented on the chart. To choose another asset, you need to select one from the drop-down list. Learn more about Forex trading sessions.

- Volume, which represents the lot size. 1.0 is equal to 1 lot or 100,000 units—profit Calculator from HFM.

- You can set Stop Loss and Take Profit at once or modify the trade later.

- The type of order can be either Market Execution (a market order) or Pending Order, where the trader can specify the desired entry price.

- To open a trade you need to click on either the Sell by Market or Buy by Market buttons.

- Buy orders open by the ask price (red line) and close by the bid price (blue line). Traders buy for less and want to sell for more. Sell orders open by the bid price and close by the ask price. You sell for more and want to buy for less. You can view the opened order in the Terminal window by pressing on the Trade tab. To close the order, you need to press the order and select Close Order. You can view your closed orders under the Account History tab.

This way, you can open a trade on MetaTrader 4. Once you know each buttons purpose, itll be easy for you to trade on the platform. MetaTrader 4 offers you plenty of technical analysis tools that help you trade like an expert on the Forex market.

How to place a Pending Orders

How Many Pending Orders in HFM MT4

Unlike instant execution orders, where a trade is placed at the current market price, pending orders allow you to set orders that are opened once the price reaches a relevant level, chosen by you. There are four types of pending orders available , but we can group them to just two main types:

- Orders expecting to break a certain market level

- Orders expecting to bounce back from a certain market level

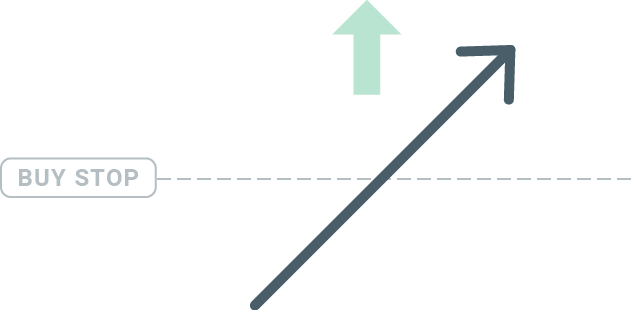

Buy Stop

The Buy Stop order allows you to set a buy order above the current market price. This means that if the current market price is $20 and your Buy Stop is $22, a buy or long position will be opened once the market reaches that price.

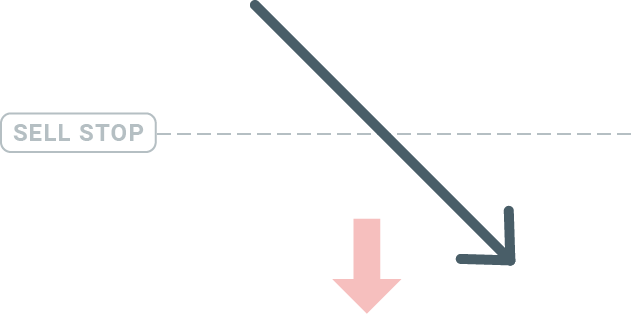

Sell Stop

The Sell Stop order allows you to set a sell order below the current market price. So if the current market price is $20 and your Sell Stop price is $18, a sell or ‘short’ position will be opened once the market reaches that price.

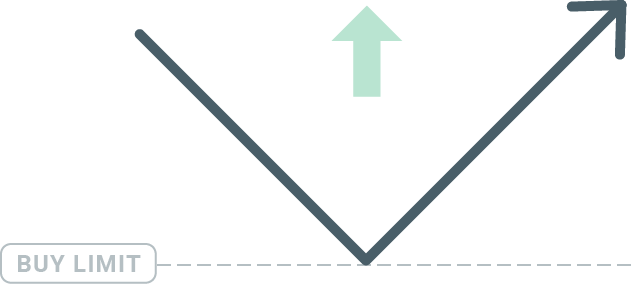

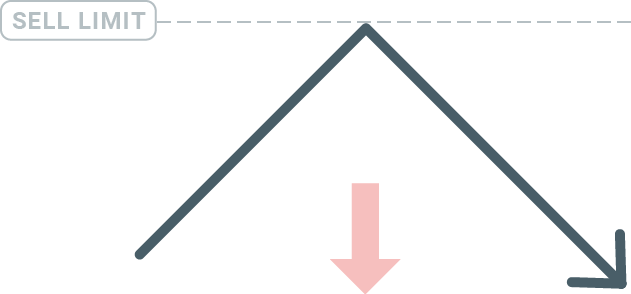

Buy Limit

The opposite of a buy stop, the Buy Limit order allows you to set a buy order below the current market price. This means that if the current market price is $20 and your Buy Limit price is $18, then once the market reaches the price level of $18, a buy position will be opened.

Sell Limit

Finally, the Sell Limit order allows you to set a sell order above the current market price. So if the current market price is $20 and the set Sell Limit price is $22, then once the market reaches the price level of $22, a sell position will be opened on this market.

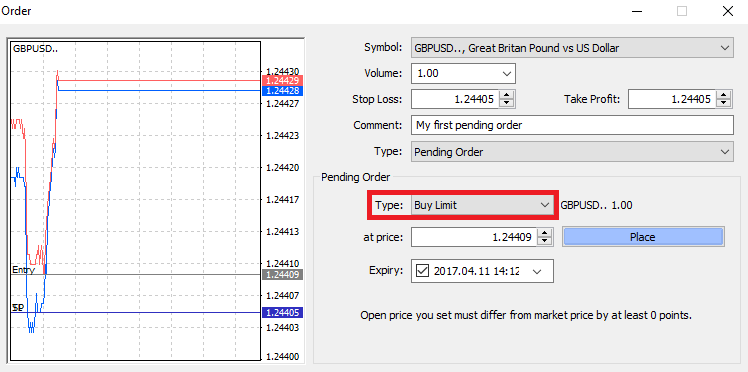

Opening Pending Orders

You can open a new pending order simply by double-clicking on the name of the market on the Market Watch module. Once you do so, the new order window will open and you will be able to change the order type to Pending order.

Next, select the market level at which the pending order will be activated. You should also choose the size of the position based on the volume.

If necessary, you can set an expiration date (‘Expiry’). Once all these parameters are set, select a desirable order type depending on whether you would like to go long or short and stop or limit and select the ‘Place’ button.

As you can see, pending orders are very powerful features of MT4. They are most useful when youre not able to constantly watch the market for your entry point, or if the price of an instrument changes quickly, and you don’t want to miss the opportunity.

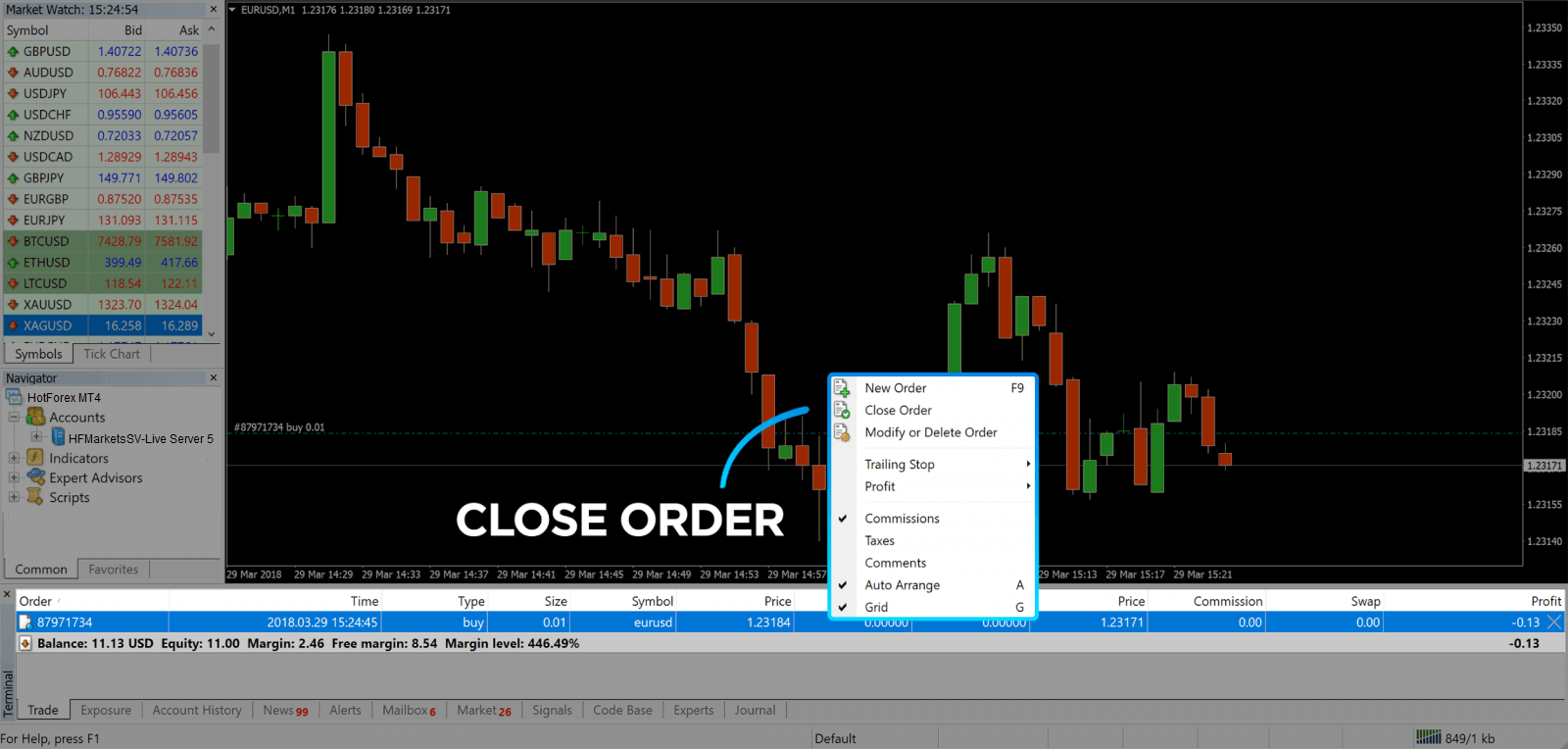

How to close Orders in HFM MT4

To close an open position, click the ‘x’ in the Trade tab in the Terminal window.

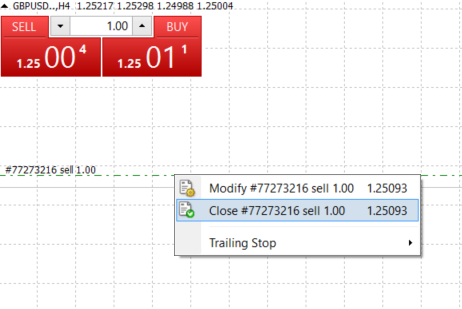

Or right-click the line order on the chart and select ‘close’.

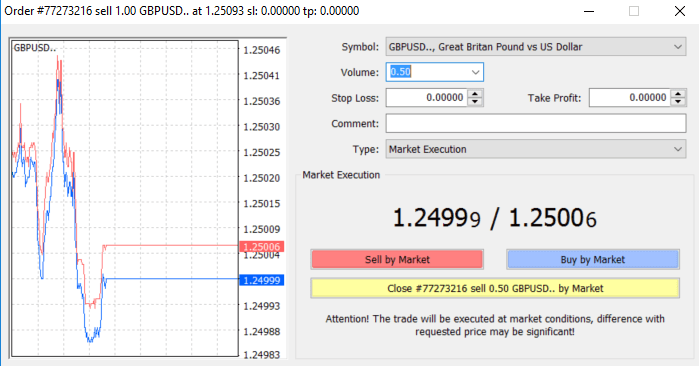

If you’d like to close only a part of position, click the right-click on the open order and select ‘Modify’. Then, in the Type field, select instant execution and choose what part of the position you want to close.

As you can see, opening and closing your trades on MT4 is very intuitive, and it literally takes just one click.

Using Stop Loss, Take Profit and Trailing Stop in HFM MT4

One of the keys to achieving success in financial markets over the long term is prudent risk management. That’s why stop losses and take profits should be an integral part of your trading.

So let’s have a look how to use them on our MT4 platform to ensure you know how to limit your risk and maximise your trading potential.

Setting Stop Loss and Take Profit

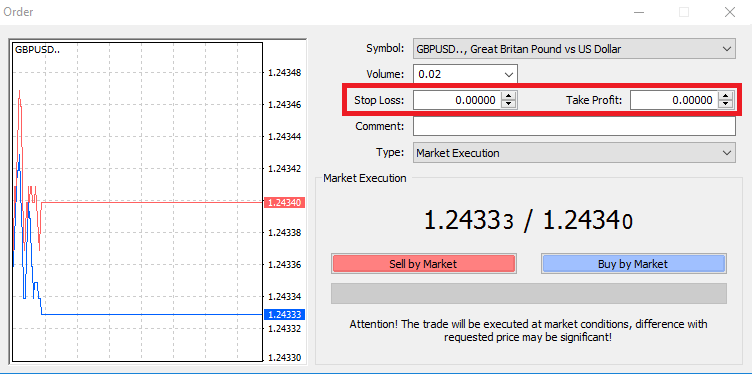

The first and the easiest way to add Stop Loss or Take Profit to your trade is by doing it right away, when placing new orders.

To do this, simply enter your particular price level in Stop Loss or Take Profit fields. Remember that Stop Loss will be executed automatically when the market moves against your position (hence the name: stop losses), and Take Profit levels will be executed automatically when the price reaches your specified profit target. This means that you’re able to set your Stop Loss level below the current market price and Take Profit level above current market price.

It’s important to remember that a Stop Loss (SL) or a Take Profit (TP) is always connected to an open position or a pending order. You can adjust both once your trade has been opened and you’re monitoring the market. It’s a protective order to your market position, but of course they are not necessary to open a new position. You always can add them later, but we highly recommend to always protect your positions*.

Adding Stop Loss and Take Profit Levels

The easiest way to add SL/TP levels to your already opened position is by a using trade line on the chart. To do so, simply drag and drop the trade line up or down to specific level.

Once you’ve entered SL/TP levels, the SL/TP lines will appear on the chart. This way you can also modify SL/TP levels simply and quickly.

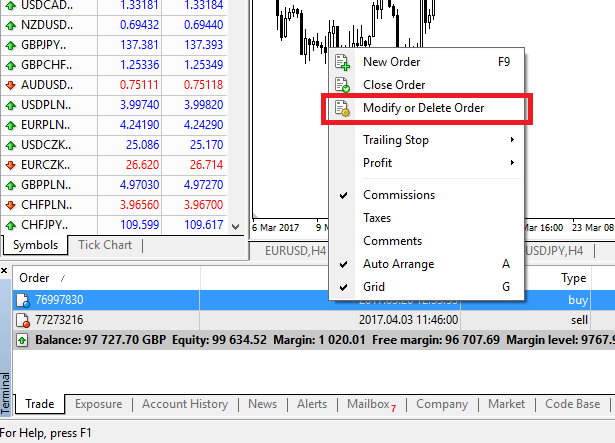

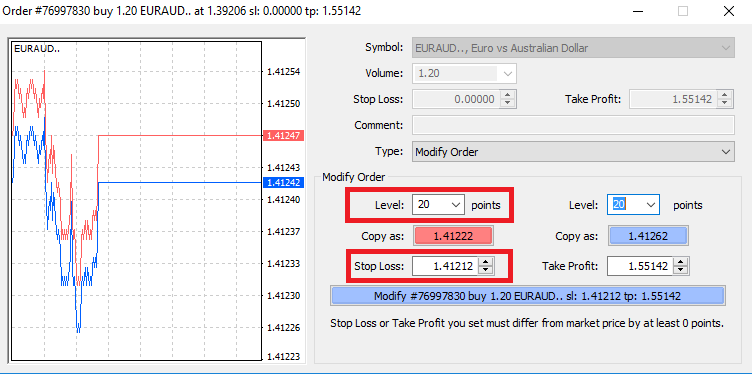

You can also do this from the bottom ‘Terminal’ module as well. To add or modify SL/TP levels, simply right-click on your open position or pending order, and choose ‘Modify or delete order’.

The order modification window will appear and now you’re able to enter/modify SL/TP by the exact market level, or by defining the points range from the current market price.

Trailing Stop

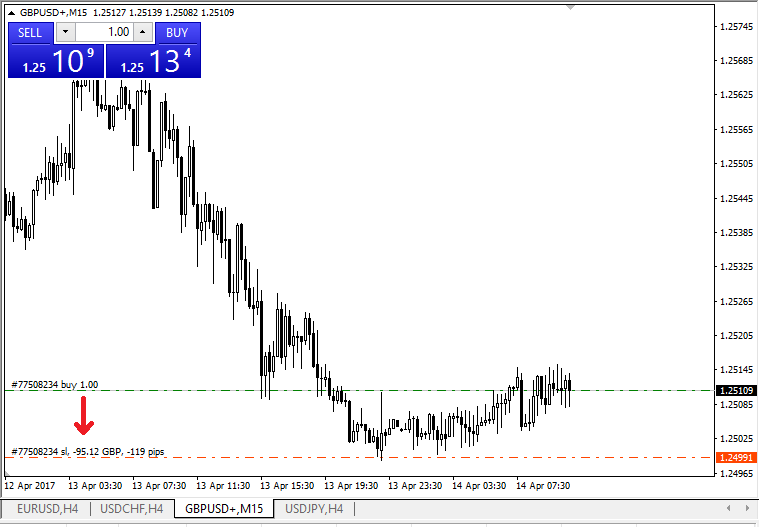

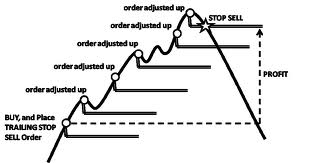

Stop Losses are intended for reducing losses when the market moves against your position, but they can help you lock in your profits as well.While that may sound a bit counterintuitive at first, its actually very easy to understand and master.

Let’s say you’ve opened a long position and the market moves in the right direction, making your trade a profitable one at present. Your original Stop Loss, which was placed at a level below your open price, can now be moved to your open price (so you can break even) or above the open price (so you are guaranteed a profit).

To make this process automatic, you can use a Trailing Stop. This can be a really useful tool for your risk management, particularly when price changes are rapid or when you’re unable to constantly monitor the market.

As soon as the position turns profitable, your Trailing Stop will follow the price automatically, maintaining the previously established distance.

Following the example above, please bear in mind, however, that your trade needs to be running a profit large enough for the Trailing Stop to move above your open price, before your profit can be guaranteed.

Trailing Stops (TS) are attached to your opened positions, but it’s important to remember that if you have a trailing stop on MT4, you need to have the platform open for it to be successfully executed.

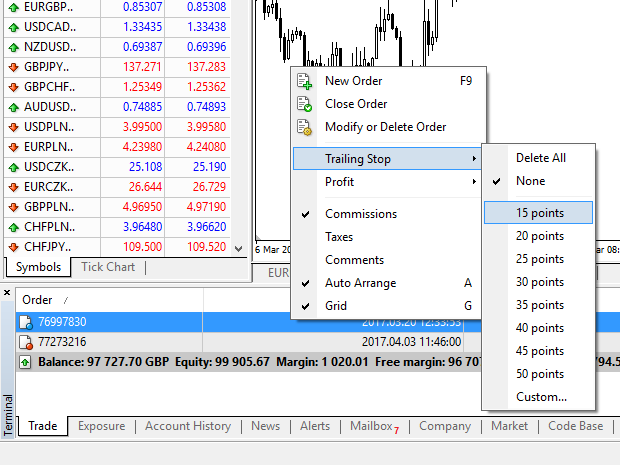

To set a Trailing Stop, right-click the open position in the ‘Terminal’ window and specify your desired pip value of distance between the TP level and the current price in the Trailing Stop menu.

Your Trailing Stop is now active. This means that if prices change to the profitable market side, TS will ensure the stop loss level follows the price automatically.

Your Trailing Stop can easily be disabled by setting ‘None’ in the Trailing Stop menu. If you want to quickly deactivate it in all opened positions, just select ‘Delete All’.

As you can see, MT4 provides you with plenty of ways to protect your positions in just a few moments.

*Whilst Stop Loss orders are one of the best ways to ensure your risk is managed and potential losses are kept to acceptable levels, they don’t provide 100% security.

Stop losses are free to use and they protect your account against adverse market moves, but please be aware that they cannot guarantee your position every time. If the market becomes suddenly volatile and gaps beyond your stop level (jumps from one price to the next without trading at the levels in between), it’s possible your position could be closed at a worse level than requested. This is known as price slippage.

Guaranteed stop losses, which have no risk of slippage and ensure the position is closed out at the Stop Loss level you requested even if a market moves against you, are available for free with a basic account.